Luxury Miami Condo Market Trends: Q3 2018 Report

Nov 01, 2018 November 01, 2018

Luxury Miami Condo Report Overall Summary

City and Neighborhood Luxury Condo Reports

Miami Beach Luxury Condo Report

South Beach Luxury Condo Report

Bal Harbour Luxury Condo Report

Sunny Isles Beach Luxury Condo Report

Greater Downtown Miami Luxury Condo Report

Edgewater / Midtown / A&E District Luxury Condo Report

Coconut Grove Luxury Condo Report

Coral Gables Luxury Condo Report

Miami Luxury Condo Market Report: Summary back to top

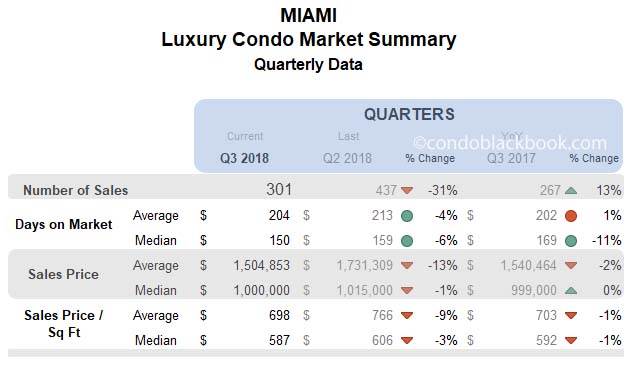

The numbers are in for the third quarter and we see signs of a healthy pick up in the luxury condo market. Sales numbers are looking good and inventory continues to shed some weight. This quarter, we feature a deeper analysis on what’s been keeping up the inflation in our price charts, read on below to find out…

For the purpose of this luxury condo report, we have only considered properties priced $600,000 and above. Also, properties priced $5 million and higher have been referred to as ultra-luxury.

Overall Market Highlights:

- Q3 sales take seasonal dive, but most neighborhoods still outdo previous year levels

- Overall Q3 days on market decline, with most neighborhoods reporting improvements over previous years

- Prices increase are caused by newer, more expensive product built 2014-2018, while the reality is that prices for existing luxury condos hover or decline

- Months of Inventory post increases, except in Sunny Isles Beach, Brickell and Coral Gables

- In spite of seasonal slowdown, market shows steady growth, hinting buyers to move quickly

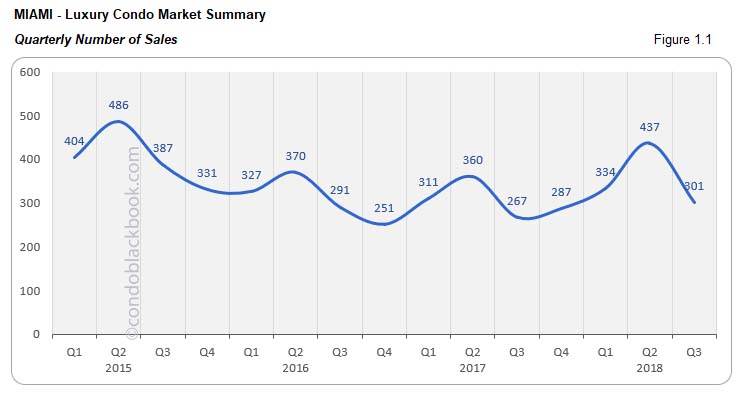

Sales take seasonal breather and yet outshine 2017 and 2016 numbers. As predicted in our previous quarter’s report, even though the third quarter did come in weaker, this year’s numbers certainly outdid 2017 and 2016’s results. A stronger economy, increased demand from SALT Tax states and prices adjusting to appeal to the current buyer’s market have kept the market momentum going even through the expected lull of the third quarter of the year.

Quarterly days on market dip. Another positive in this quarter’s study is that the days on market are lower compared to the previous quarter, and last year. This goes on to show that buyers and sellers have been seeing eye to eye faster. It shows that sellers have been reasonable with asking prices and buyers too are being rational with negotiations.

Overall prices deflate, only newer constructions keep price metrics up, as prices on existing constructions decline or remain flat. We had been noticing an upsurge in our charts that did not match up to the ground reality of prices in the luxury condo segment. So, we decided to split up the values according to the age of construction to figure out what fueled this volatility. Once the fresh built product (2015-2018) was removed from the rest, we found that prices had remained sideways for condos built 2000-2014 and gone down for pre-1999 condos. Price increases were only limited to condos built 2015-2018.

Inventory takes a break to trek upwards. After months of hitting new lows, we see the months of inventory move upwards this quarter. However, this uptick has been quite reasonable given the pace of the market, and is actually lower compared to previous year numbers. We expect the trend to continue flat or downwards in upcoming months.

Overall, the market still shows signs of positivity this third quarter. We’re hoping that trends will keep in the remaining quarters to bring the luxury condo market back to balance by 2019. Until then, buyers can enjoy the luxuries a favorable market brings with it.

Where Does the Market Go From Here?back to top

With a strengthening market ready to loosen this buyers’ grip, the following factors could (and some have even started to) take effect to help nudge the market towards a balance:

- High tax states push forth new wave of buyers. Post the implementation of the SALT tax laws, we continue seeing an increased demand from residents of high tax states. With all these taxes to save as a resident of Miami, it is no wonder that out-of-towners have been making more and more inquiries.

- Fresh inventory reels in buyer motivation. Though newly built condos do add to inventory, they also offer a distinctive product. The appeal of world-class amenities, in-demand features, high-profile brand names and more is hard to resist for most buyers.

- Lower priced condos built pre-2014 pique buyer interest. Striking the right balance between lifestyle and value for money, condos built before 2014 are being priced to appeal to the demands of the current buyer’s market. Prices in this segment have been steady or declined over the past year, as can be seen in the detailed price analysis below.

- A sideways stock market makes real estate fertile ground. With the stock market holding up in 2018, and moving up since 2016, investors can find real estate to be the perfect place to park their gains.

- Higher interest rates could be the perfect nudge for some. As more and more people get wind of an imminent increase in interest rates, there could be a sense of urgency that takes over first-time buyers, pushing them to make a purchase sooner.

Below is an insight into Miami’s overall and neighborhood-level luxury condo trends for Q3 2018:

Monthly Number of Sales - Miami Luxury Condo Market Overall back to top

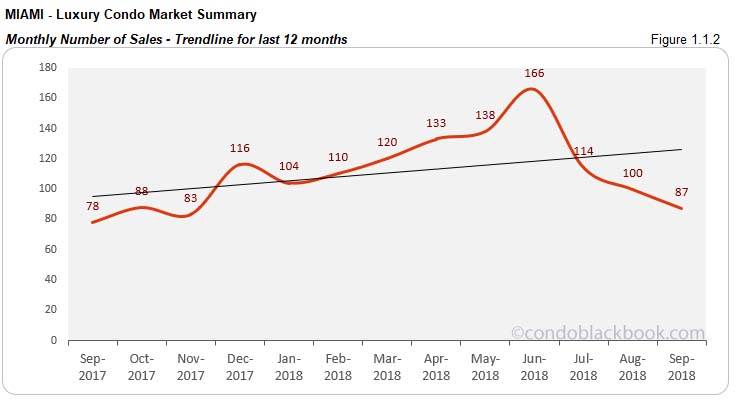

Sales take seasonal break, but outperform previous two years with positive trend line. In fig. 1.1 below, we see the overall sales taking their usual seasonal break and dipping 31% against Q2. However, a closer look reveals that the third quarter did outperform Q3 2017 by 13% and Q3 2016 by a margin as well. Along with a positive monthly trend line in fig. 1.1.2, it is safe to say that sales have held onto their momentum through this third quarter.

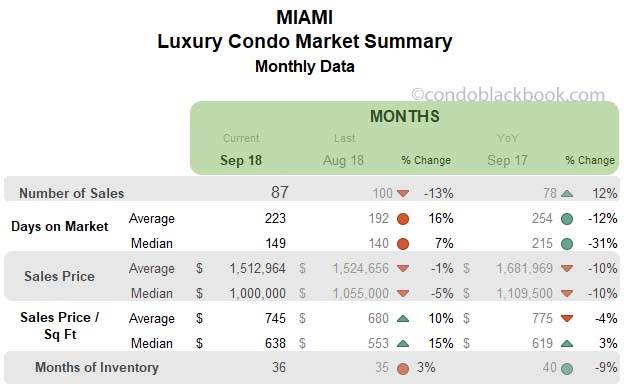

Days on Market - Miami Luxury Condo Market Overall back to top

“Days on market” are the total number of days from when a property is active to the day it goes under contract.

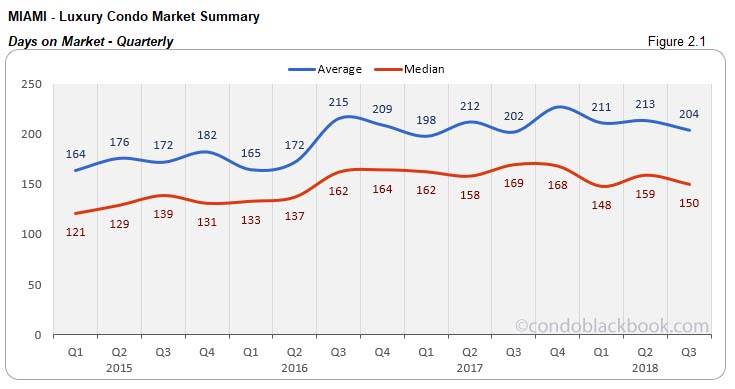

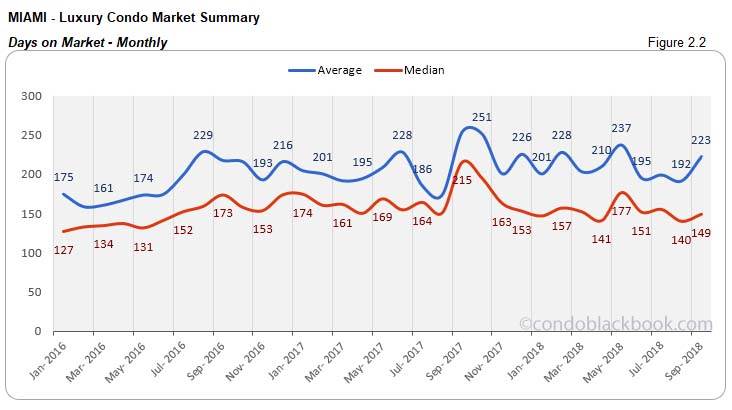

Days on market tip lower, improve over previous two years. We see luxury condos spent 4% less time on the market this quarter, as the median days on market decline against Q2. Fig. 2.1 also shows how luxury condos spent less time on the market compared to Q3 2017 and Q3 2016, which is a significant improvement for the market in Miami.

Sales Price Trends - Miami Luxury Condo Market Overall back to top

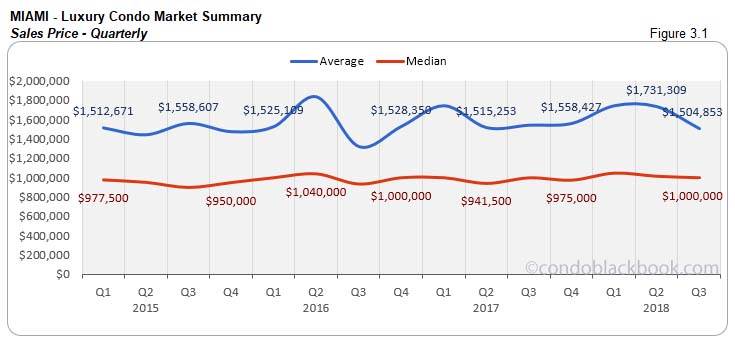

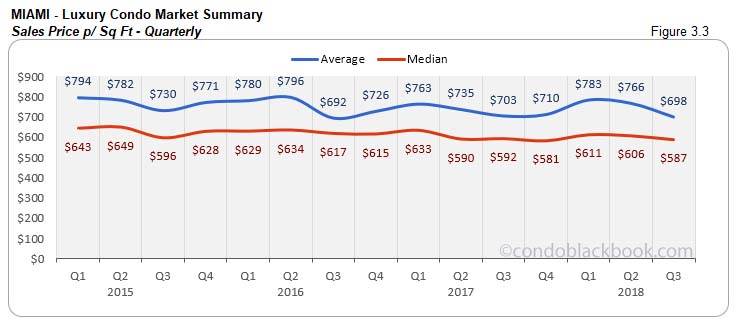

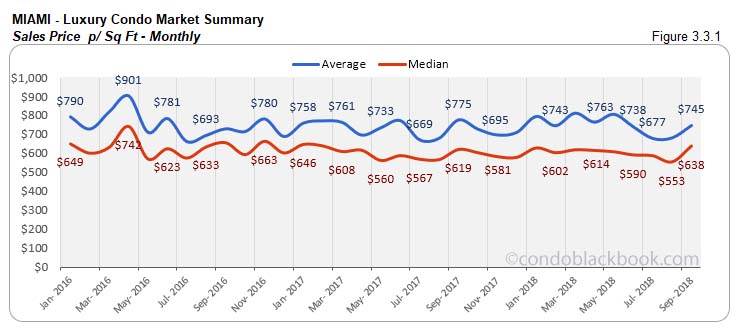

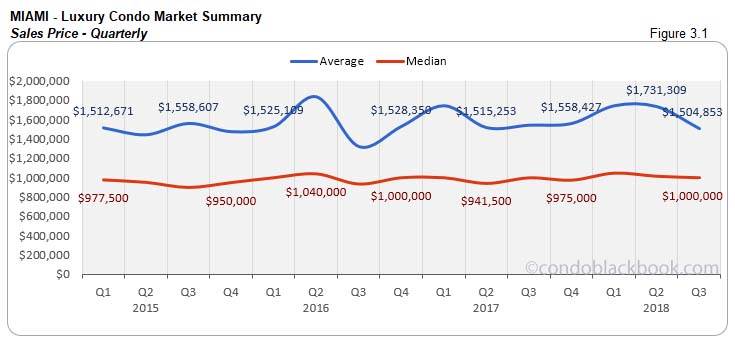

Overall prices in Q3 stay consistent against last year. In our overall luxury condo market analysis above, we see that the median price and price per sq. ft. hover around previous year levels. The median prices in Q3 do not deviate much either, posting only a slight dip against Q2. (See charts 3.1 and 3.3) Below is a detailed analysis of prices on the basis of age of construction.

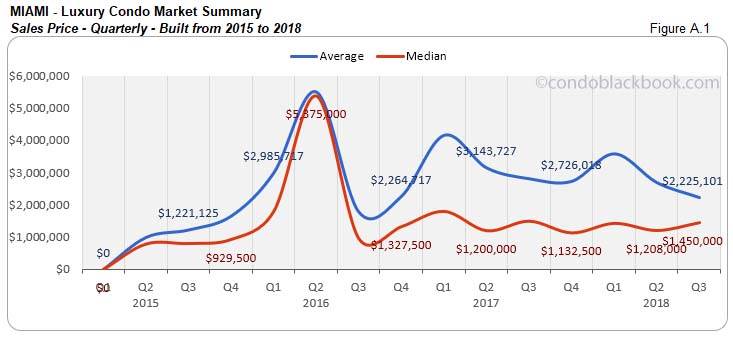

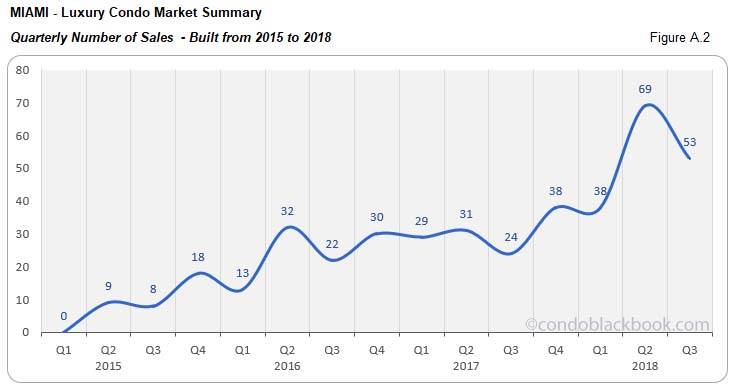

Uptick in prices for luxury condos built 2015 to 2018. Even as we see a decline in sales figures (fig. A.2) for newer condos built 2015 to 2018, the median sales price went up quarter-over-quarter (fig. A.1). This goes on to solidify our observations (mentioned in previous reports) that the newly delivered condo product which is inherently more expensive, is pushing the overal market prices higher. And, the steep highs of this segment have made a deep impact on previous charts.

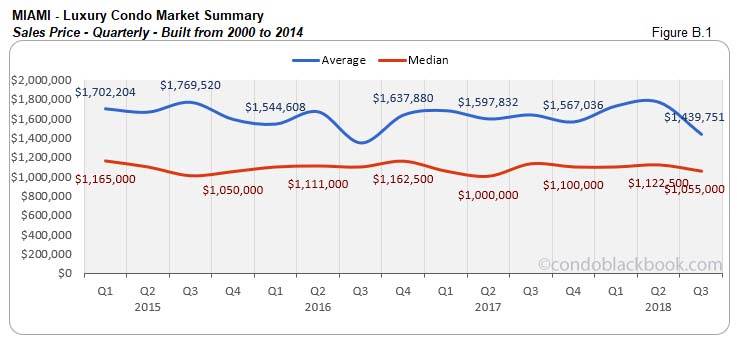

Prices hover for luxury condos built 2000 to 2014. In fig. B.1, we see a marginal dip in the quarter-over-quarter median sale prices. Also, there is very little volatility in this segment, with prices hovering mostly around the million-dollar mark.

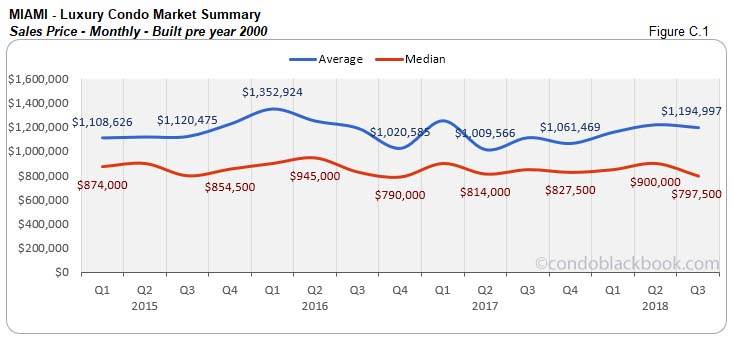

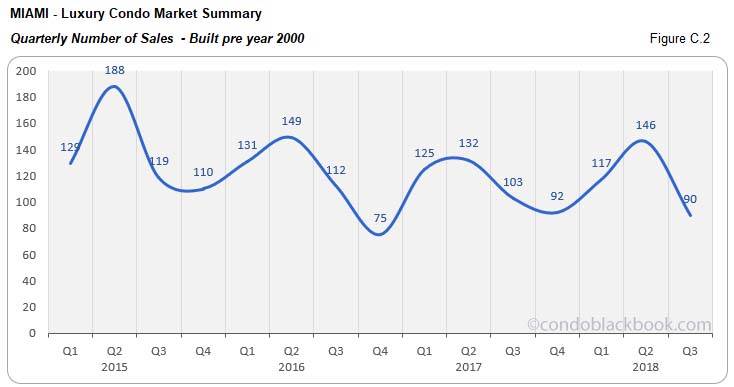

Prices decline for luxury condos built 1999 and earlier. In fig. C.1, we see quite a dip in the median sale prices compared to Q2. Though this segment too hovered around the million-dollar mark for most part of the year, Q3 came in with a decline.

Sales Price Trends considering Building year - Miami Luxury Condo Market Overall back to top

ALL BUILDINGS

BUILDINGS (2015 to 2018)

BUILDINGS from 2000 to 2014

BUILDINGS from 1999 and older

Inventory Trends - Miami Luxury Condo Market Overall back to top

A balanced market will only have 9-12 months of inventory. The months of inventory are calculated as – no. of active listings + no. of pending listings divided by the average number of deals in the last 6 months.

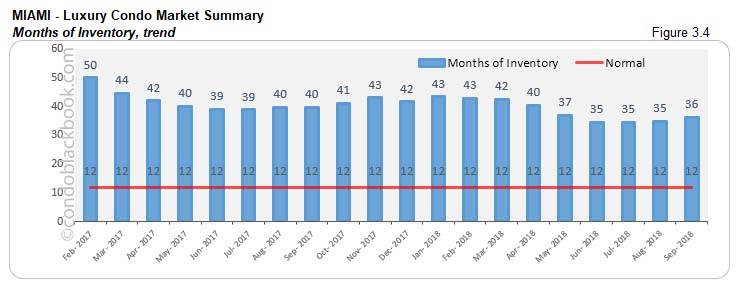

Inventory nudges up, but deflates year-over-year. Just as the sales charts take a breather, we see the months of inventory move along too. Fig. 3.4 shows the quarter closing with 36 months of inventory, which is slightly higher than what it’s been since June this year and definitely far from the 9-12 month ideal. However, the metric is still 9% lower compared to September 2017, showing that the market has made progress over the past year.

City and Neighborhood Market Reports back to top

Miami Beach Luxury Condo Market Summary back to top

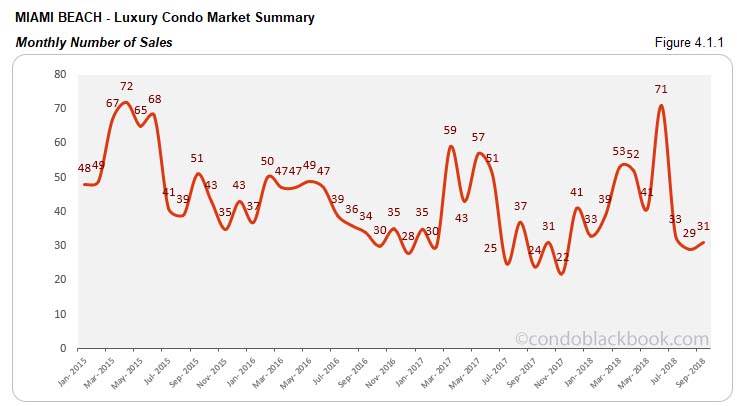

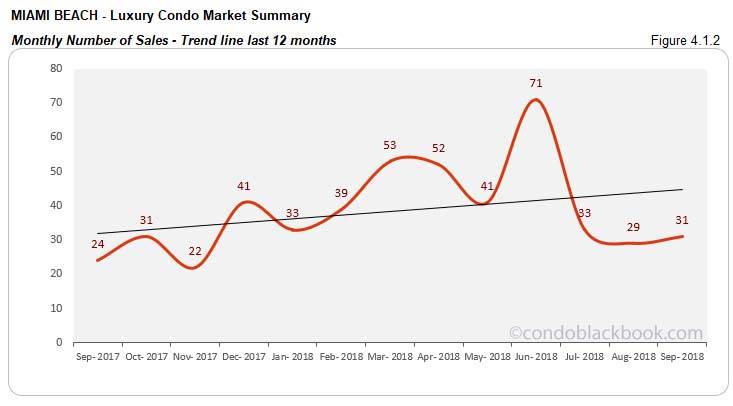

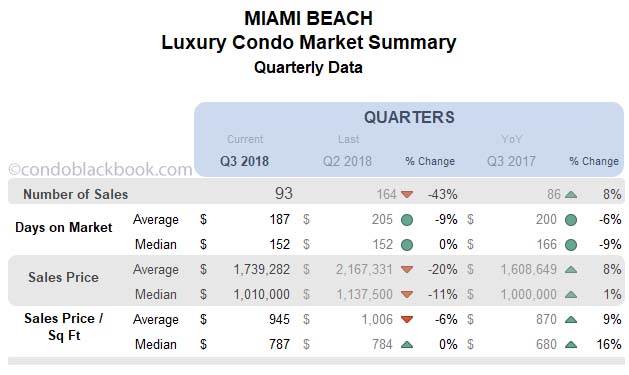

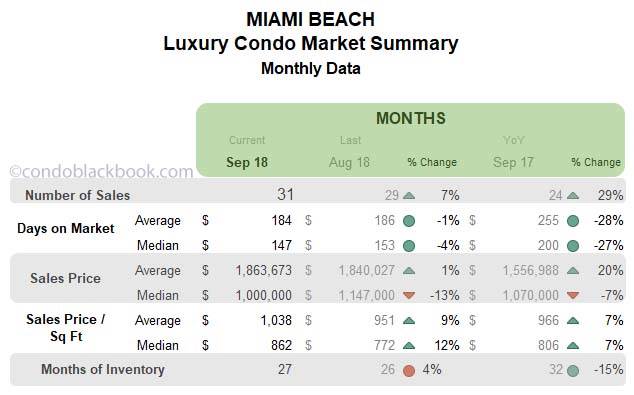

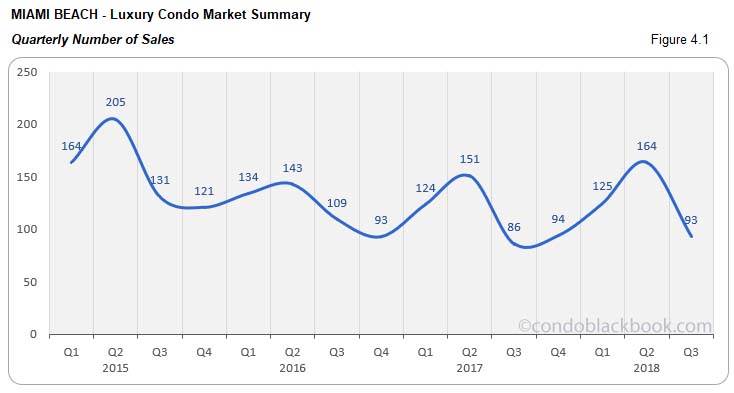

Q3 sales dip, but improve YoY with positive trend line. We see the market taking a break this quarter by posting a 43% decline in sales against Q2. However, compared to last year, Q3 posts an 8% increase (fig. 4.1.2). This improved momentum also shows itself in the trend line tracing sales over the last 12 months in fig. 4.1.2, by maintaining an upward tilt.

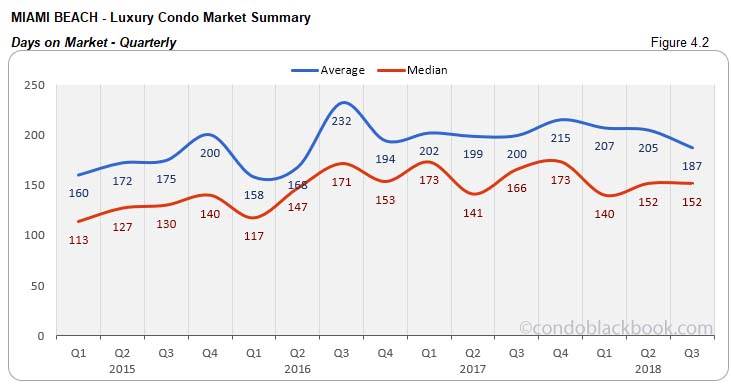

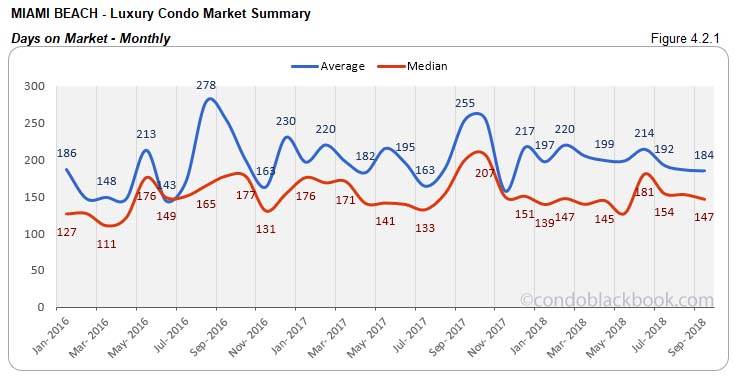

Days on Market decline YoY. Even though the median days on market remained the same as Q2, we see a 9% decline year-over-year. This indicates that buyers and sellers came to a consensus sooner in Miami Beach. (see fig. 4.2 below)

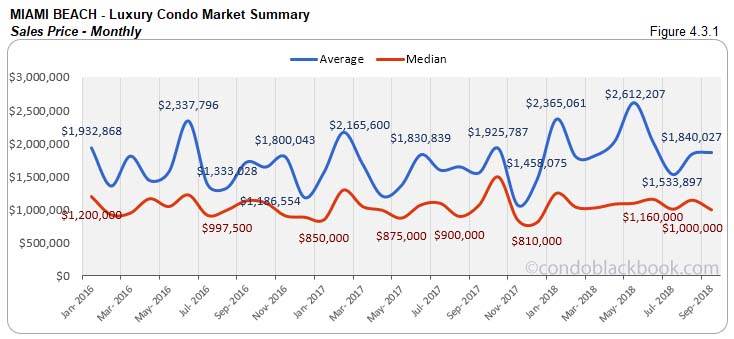

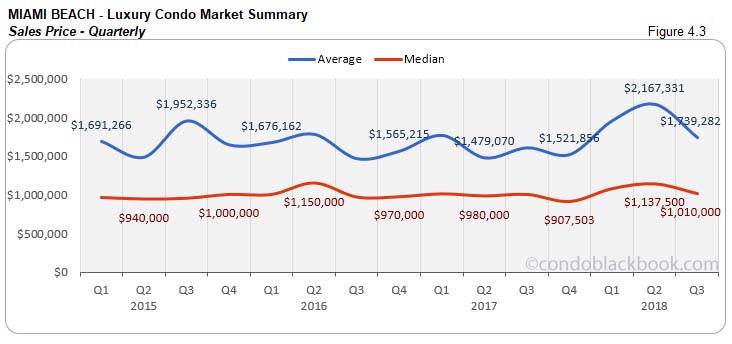

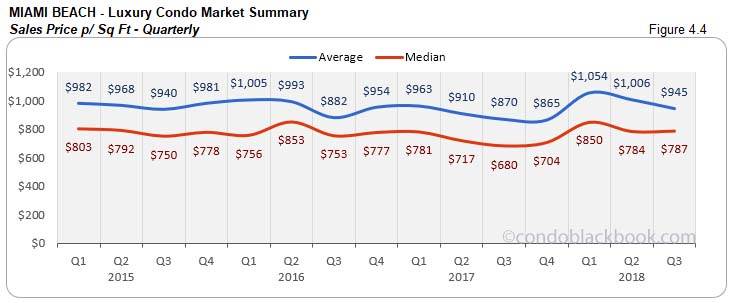

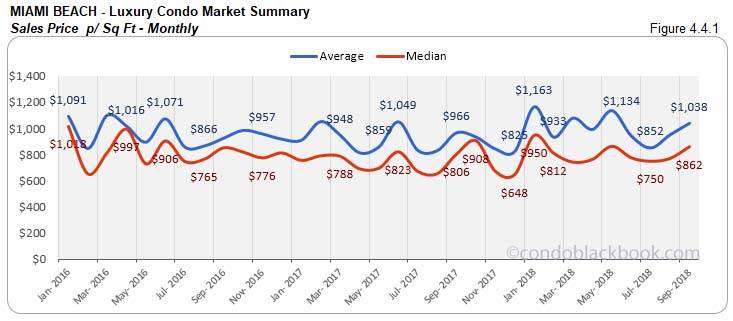

Prices decline QoQ, but hover YoY. We see the median price in Miami Beach dive 11% against Q2, while the price per sq. ft. registers a negligible change. Compared to last year, prices are pretty much the same for this coastal neighborhood with the median posting only a 1% uptick. (see fig. 4.3 and 4.4 below)

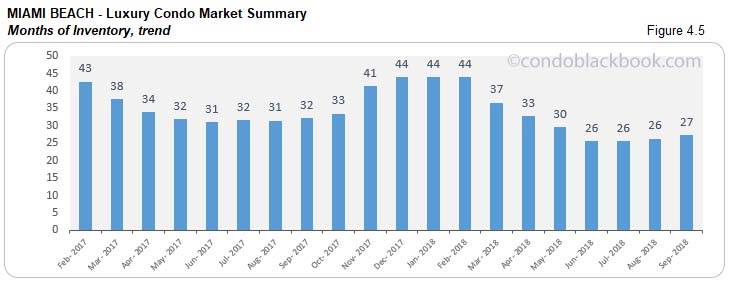

Inventory increases quarter-end, but dives 15% YoY. The third quarter closes with a 4% increase in months of inventory, as sales take their seasonal break. However, at 27 months, inventory is still 15% down from September 2017. This just shows that slowly, but steadily the months of inventory are inching towards the ideal mark of 9-12 months. Also, this gives buyers a shorter window of opportunity to hunt for deals as they search for Miami Beach condos for sale here.

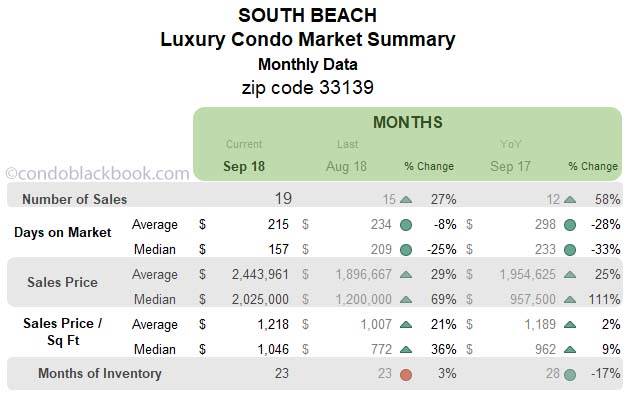

South Beach Luxury Condo Market Summary (33139 zip) back to top

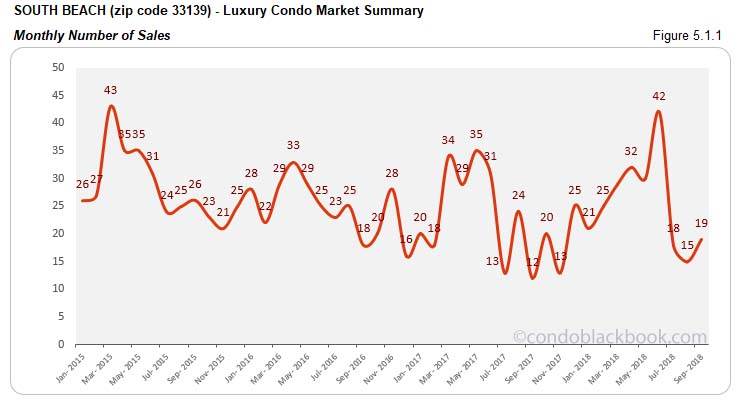

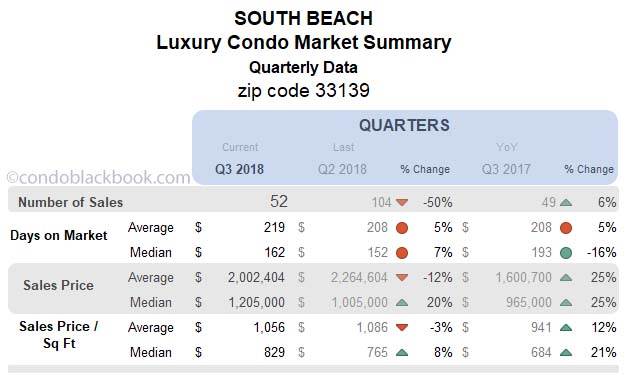

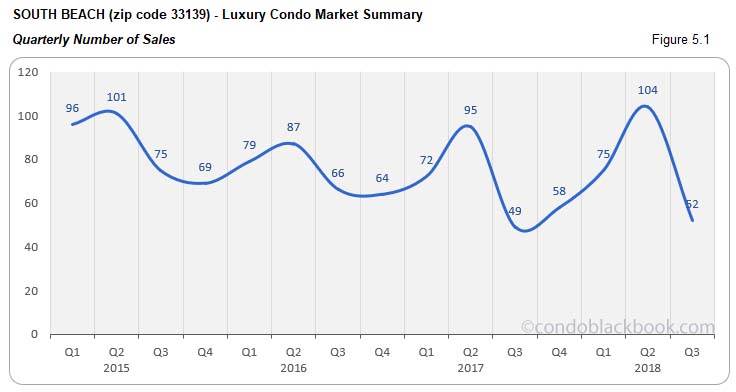

Seasonal lull takes over Q3 sales, but YoY numbers and trend line stay positive. South Beach reports a 50% decrease in sales over Q2. While this suggests a heavy dip, the metric is still 6% higher than Q3 2017 (fig. 5.1). This, and an upward tracing trend line in fig. 5.1.2 below show that the positive market dynamic keeps in this vacation hotspot.

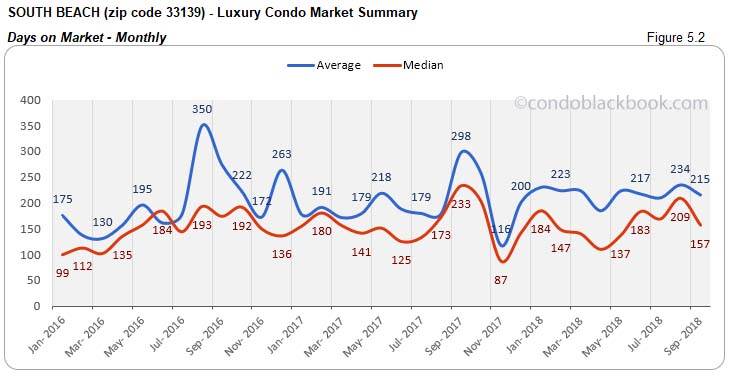

Quarterly days on market inch up 7%, but deflate YoY. Luxury condos in Q3 took 10 days longer to get off the market (on median), capturing slower dialogue between buyers and sellers. However, the metric is 16% lower than same quarter 2017, showing that there is a definite improvement over last year.

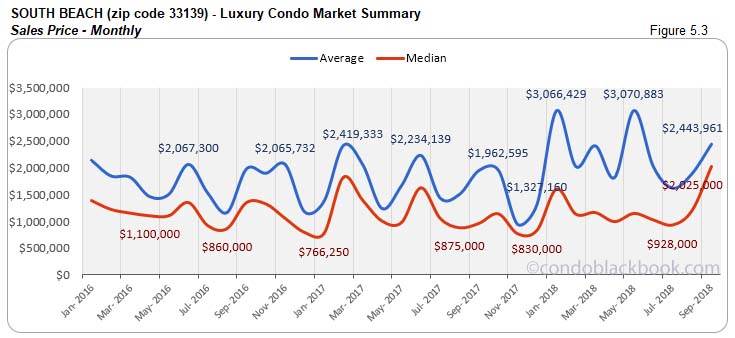

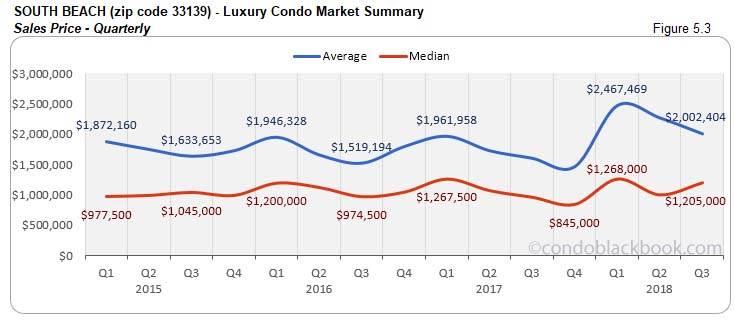

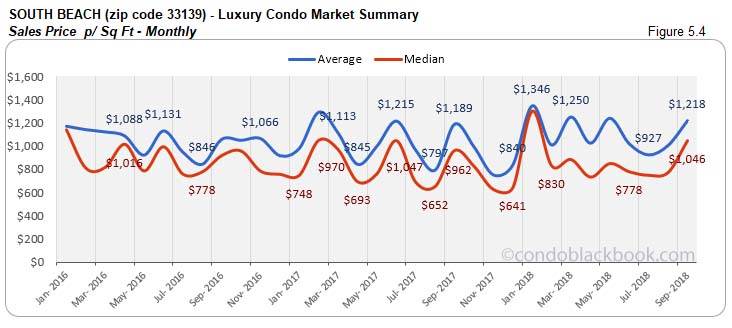

Quarterly and YoY prices spike due to ultra-luxury deals. Q3 posts a significant spike in its price and price per sq. ft. The median price is up 20% since Q2 and 25% compared to Q3 2017 (fig. 5.3). The price per sq. ft. is up 8% over the previous quarter and 21% over last year (fig. 5.4). Six ultra-luxury deals (above $5 million), including one deal worth $14 million, are the cause of this sudden boost. The quarter closed with a median price of $829 per sq. ft.

Inventory up at quarter-end, but 17% lower YoY. Taking a break from its downward trend, we see the months of inventory increase 3% by the end of the third quarter. However, a year-over-year comparison shows a significant decline. At 23 months, inventory is getting closer to reaching its ideal mark of 9-12 months. In the meanwhile, buyers are advised to hurry and grab this short window of opportunity by searching South Beach condos for sale here, or taking a tour of the neighborhood here.

Mid-Beach Luxury Condo Market Summary (33140 zip) back to top

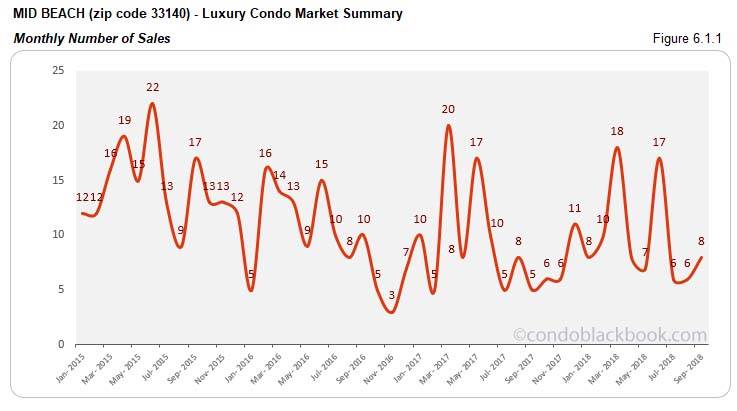

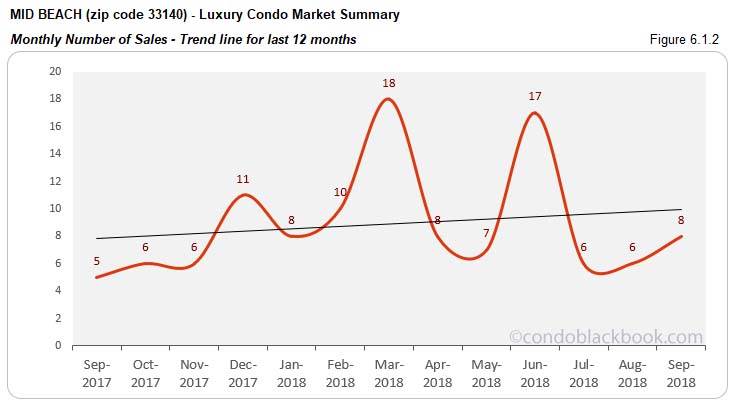

Quarterly sales succumb to seasonal lull, but YoY numbers strengthen with positive trend line. We see a 38% decline in the quarter-over-quarter sales in Mid-Beach. However, they are still 11% higher compared to same quarter last year. This shows that even though the market took a seasonal break, it did not lose its momentum. A positive trend line in fig. 6.1.2 below reinforces the fact.

Days on market reduce 26% QoQ. Luxury condos spent 38 less days on the market in Q3 compared to Q2, but took 3 days longer year-over-year (on median). This shows that buyers and sellers found it easier to see eye to eye on negotiations this quarter. (see fig. 6.2 below)

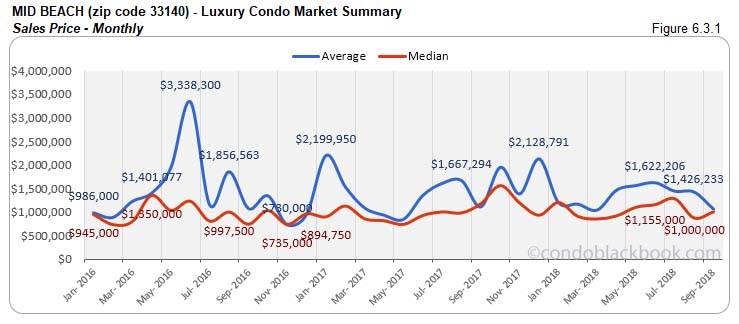

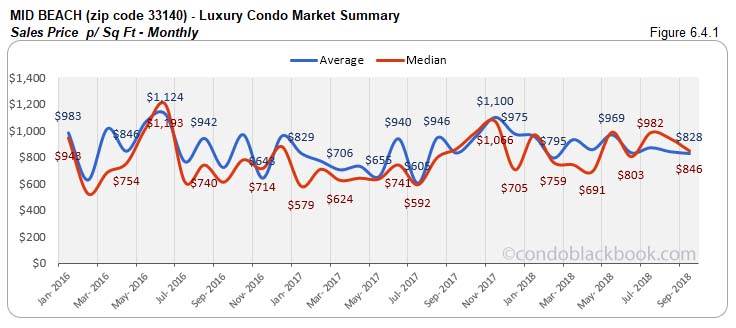

Prices reduce QoQ, but stay consistent YoY. Q3 posted a 10% decline in the quarter-over-quarter median sales price. A year-over-year analysis showed that prices have been consistent in Mid-Beach, hovering around the million-dollar mark (fig. 6.3). The quarter ended with the median price per sq. ft. closing at $914 (fig. 6.4).

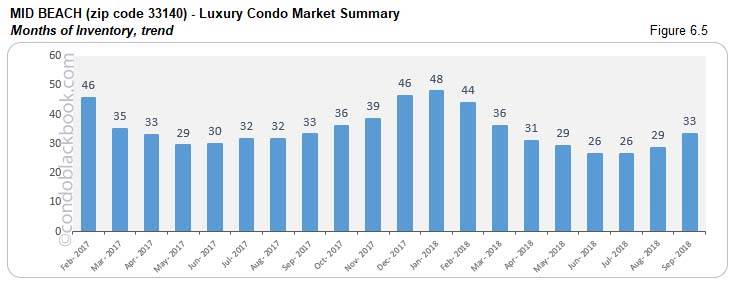

Inventory increases 17% to match YoY numbers. The seasonal sluggishness of the market shows its impact on the months of inventory by increasing the metric 17%. Matching previous year levels at 33 months, inventory is currently way off from reaching the ideal 9-12-month benchmark of a balanced market. Buyers should make the most of the situation and grab for deals by searching Mid-Beach condos for sale here, or start out with a tour here.

Surfside Luxury Condo Market Summary back to top

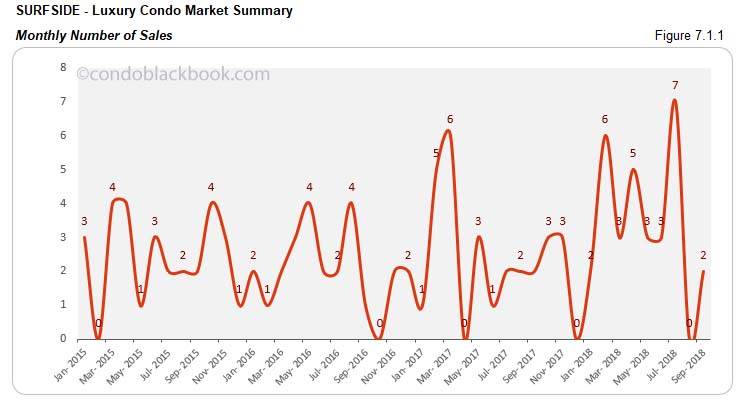

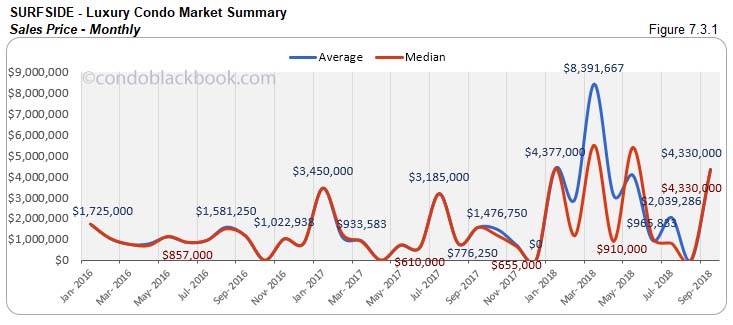

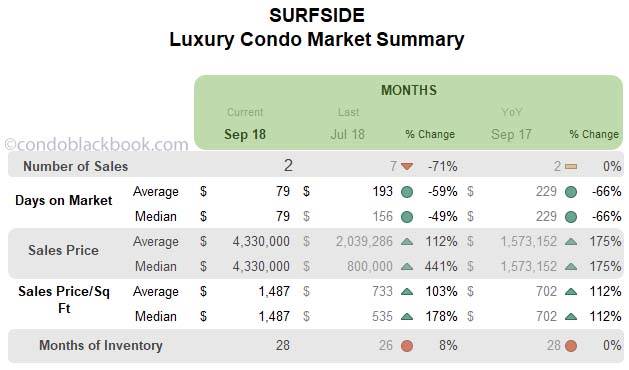

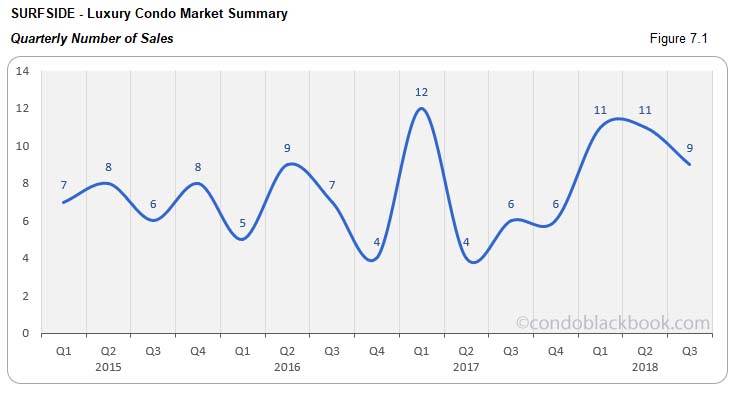

Seasonal sluggishness gets QoQ sales, but YoY analysis and trend line remain positive. Q3 posts an 18% decline over the previous quarter in Surfside. However, a closer look at fig. 7.1 reveals that Q3 this year outperformed results from 2017, 2016 and 2015, in spite of zero sales in August. This, together with an upward tracing trend line in fig. 7.1.2 show that the market here has retained its boost despite the seasonal sluggishness.

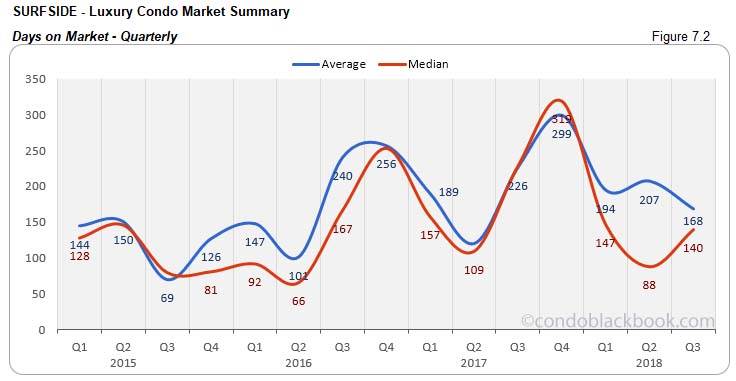

Days on market increase QoQ, but dip YoY. Luxury condos in Q3 took 52 days longer (on median) than Q2 to get off the market. However, they took 89 days less compared to Q3 2017, showing that over the year buyers and sellers started coming to a consensus sooner.

Overall prices post reduction. Even with Surfside being a small market for luxury condos and metrics usually being volatile, we notice a decline in the prices for the coastal neighborhood. The median price is down 26% quarter-over-quarter and 10% lower year-over-year. The median price per sq. ft. for Q3 closed at $587. (see fig. 7.3. and 7.4 below)

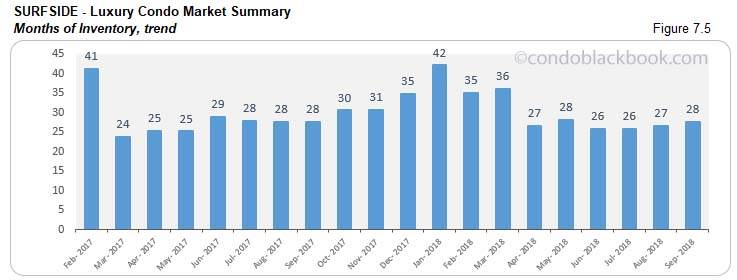

Inventory nudges up 8%. As a direct impact of sluggish sales, we see an increase in the months of inventory. At 28 months, inventory is now 8% higher than the close of last quarter and matching previous year levels. Moving away from the ideal 9-12 months of a balanced market, buyers still have ample opportunity to lead negotiations as they look for a Surfside condo for sale here, or see what lifestyle makes up Surfside here.

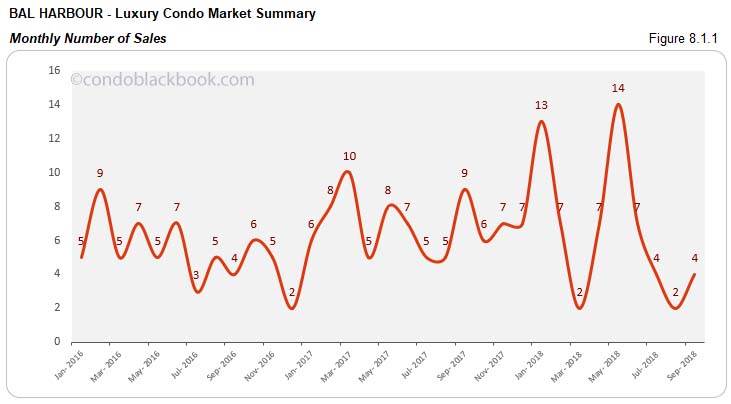

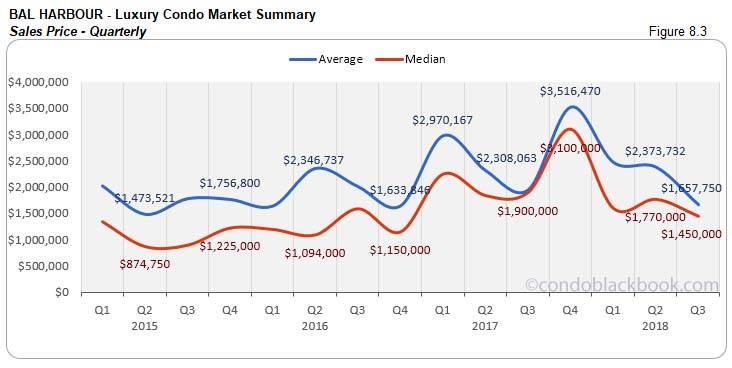

Bal Harbour Luxury Condo Market Summary back to top

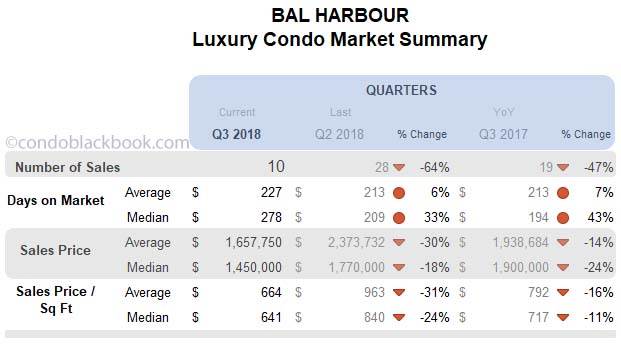

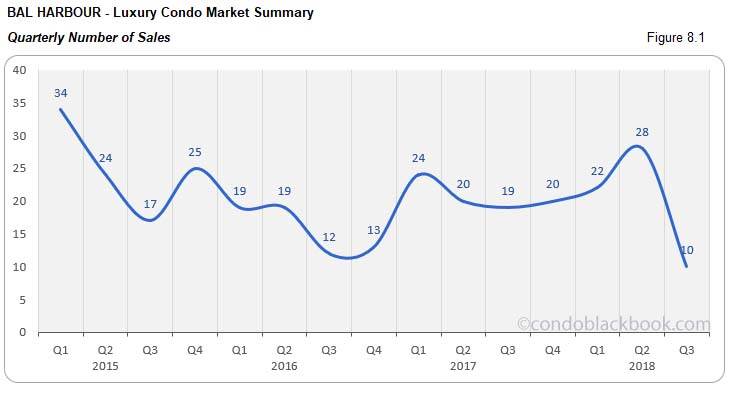

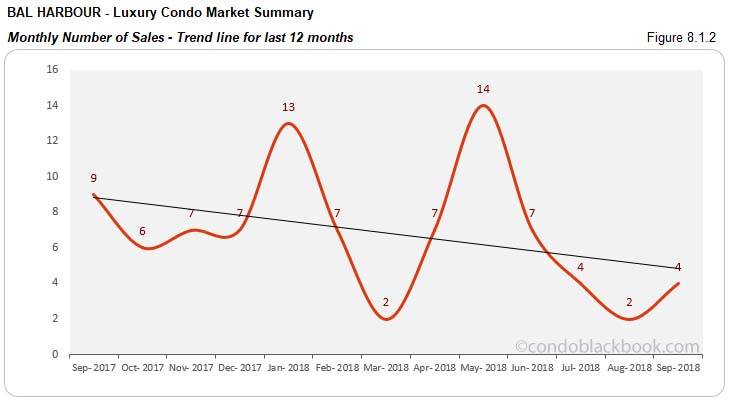

Sales for quarter hit speed breaker, posting negative trend line. After a good couple of quarters, we see sales almost hitting the brakes in Bal Harbour. There is a 64% quarter-over-quarter decline and 47% year-over-year reduction (fig. 8.1). This has also left a negative impact on the trend line in fig. 8.1.2 below, with it now sloping downwards. We will be keeping an eye on this market to see if the trend reverses soon enough or not.

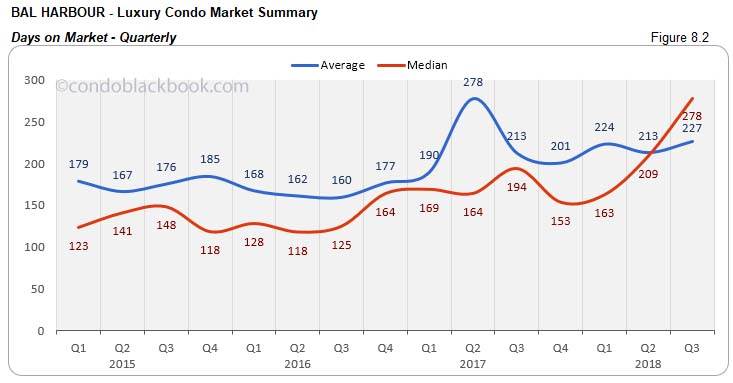

Days on market up 33% QoQ and 43% YoY. Luxury condos in Q3 took 69 days longer (on median) than Q2 to get off the market. Even on a year-to-year basis, condos stayed on the market 84 days longer (on median), showing how buyers and sellers found it tough to find middle ground.

Prices deflate QoQ and YoY. There is an 18% decrease to report in the median sales price against Q2 and 24% decline against Q3 last year. This reiterates our observation from previous reports that prices have been declining to accommodate the current buyer’s market, with only ultra-luxury or newly built condo sales inflating charts. Q3 closed with the median price at $641 per sq. ft. in Bal Harbour. (see fig. 8.3 and 8.4 below)

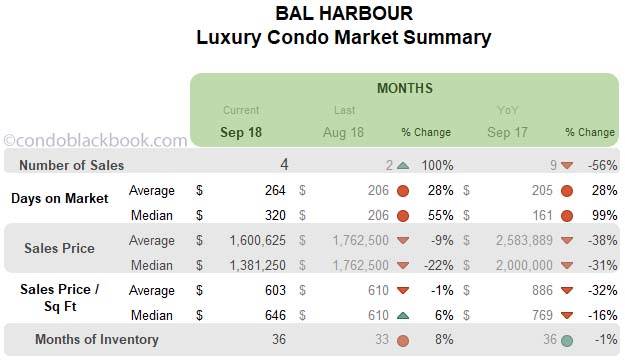

Inventory continues ascent, but still below previous year levels. After coming down to its lowest in May, we see an 8% increase in inventory from August to September. However, the stylish neighborhood still came a percentage short of previous year levels. At 36 months, and with slower sales, inventory is far from reaching the 9-12-month ideal of a balanced market. Buyers should take this as an opportunity and search for Bal Harbour condos for sale here, or check out details on the upscale neighborhood here.

Sunny Isles Beach Luxury Condo Market Summary back to top

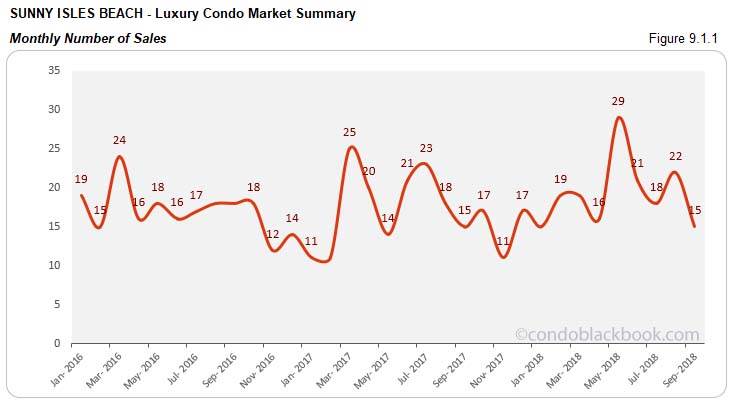

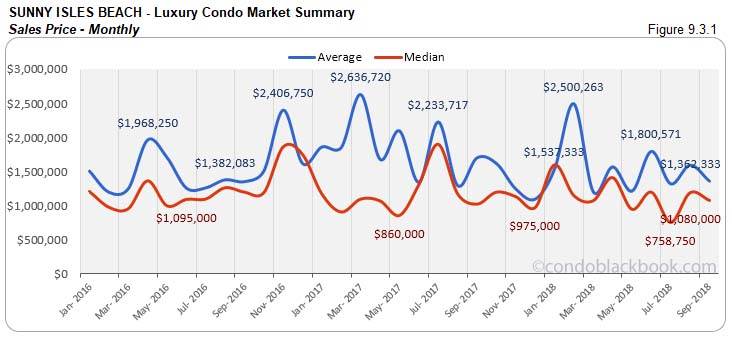

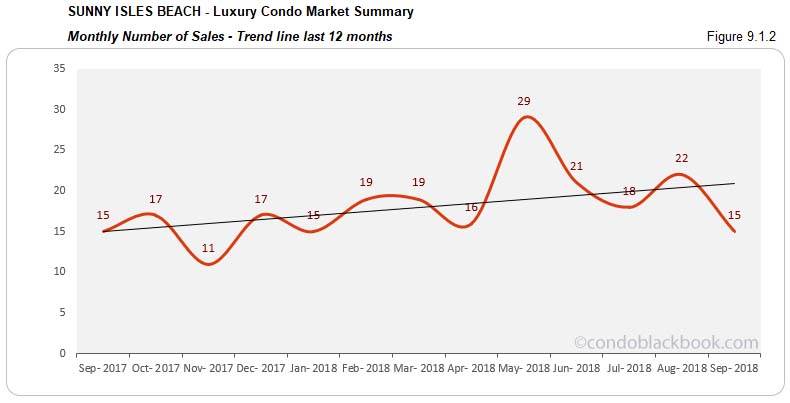

Sales slip with seasonal break, but trend line stays positive. We see Q3 sales posting a 17% decline over Q2 and 2% decline over same quarter last year. Even as sales swing to the tune of the season, we see a positive trend line in fig. 9.1.2, showing that the luxury condo market in Sunny Isles Beach did not lose its momentum.

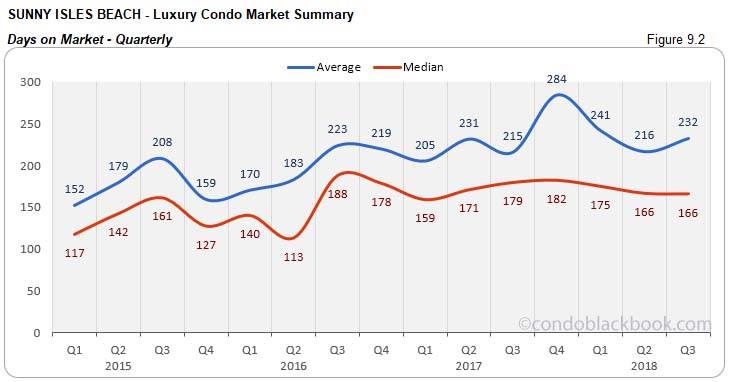

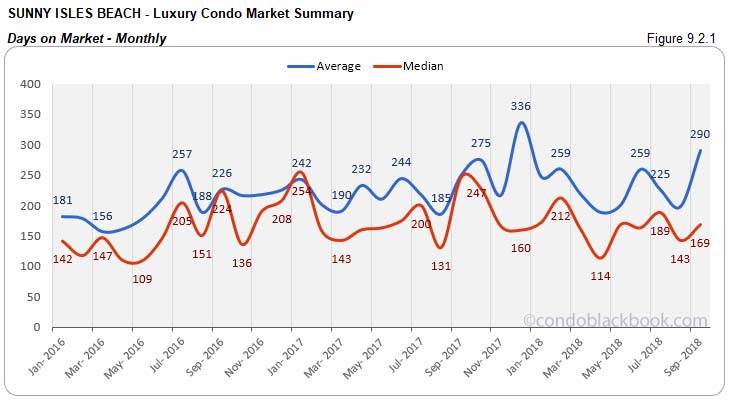

Days on market down 8% YoY. Luxury condos took the same amount of time to get off the market in Q3 as they did in Q2. Compared to Q3 2017, they took 13 less days to go off the market this quarter. This shows that buyers and sellers have been reaching a consensus sooner in Sunny Isles Beach.

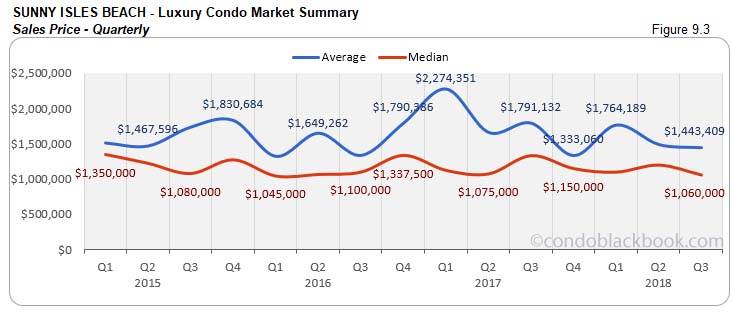

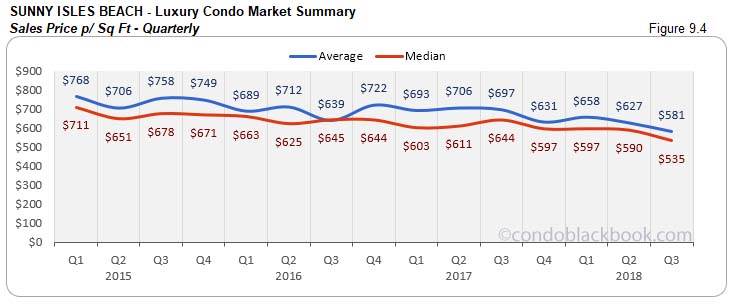

Prices post decline in QoQ and YoY charts. We see a decline in both the quarter-over-quarter and year-over-year metrics for Sunny Isles Beach. There is a 12% decline in the QoQ median sales price and 21% decrease YoY. Also, the price per sq. ft. reduced 9% QoQ and 17% YoY. This closed the quarter at $535 per sq. ft. median price. (see fig. 9.3 and 9.4)

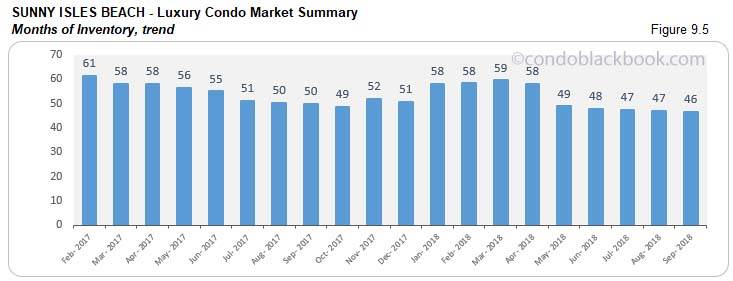

Inventory posts 1% quarter-end and 7% YoY reduction. One of just three neighborhoods to report a decline in inventory in our study, Sunny Isles Beach posts 46 months of inventory. Way off the 9-12-month mark of a balanced market, buyers have a good window of opportunity to strike advantageous deals as they search Sunny Isles Beach condos for sale here or begin by exploring the lifestyle options here.

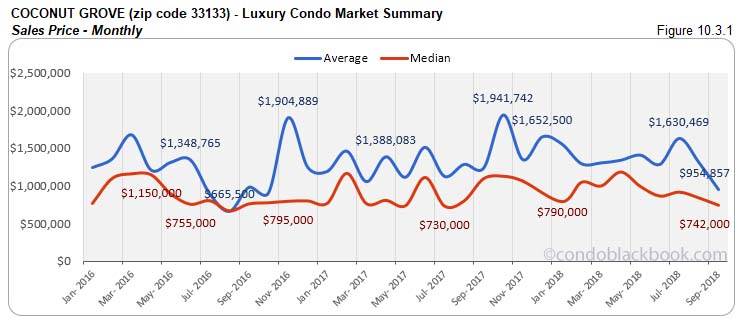

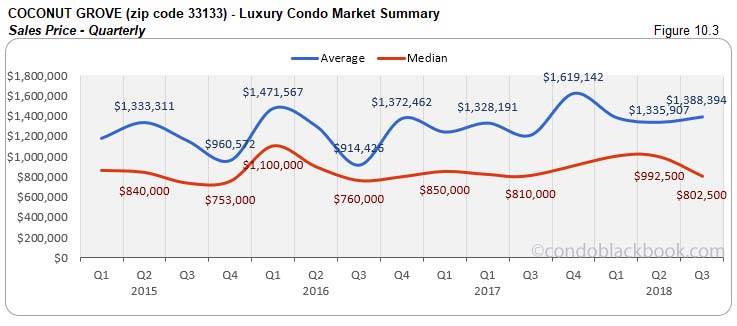

Coconut Grove Luxury Condo Market Summary (33133 zip) back to top

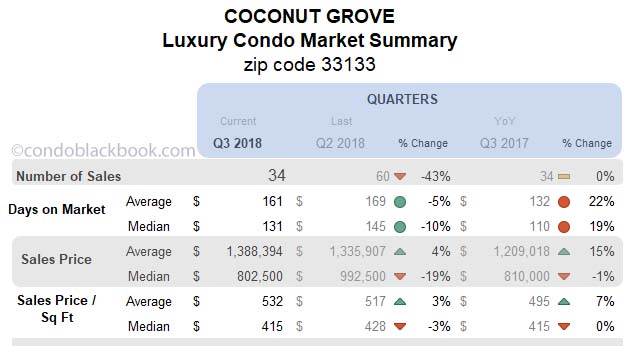

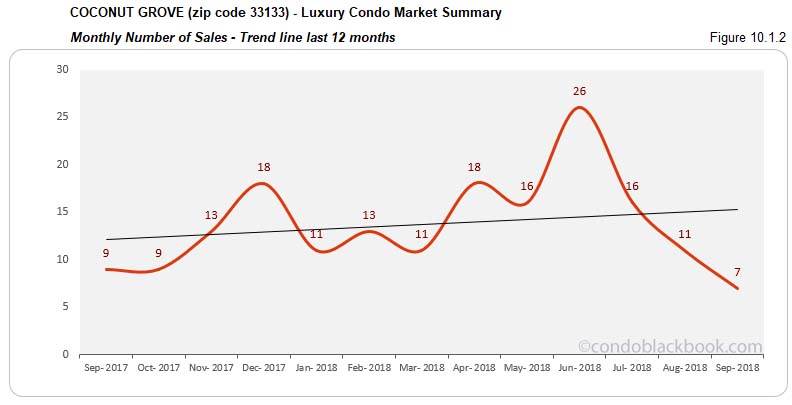

Seasonal dip affects Q3 sales, but stay positive YoY with upward trend line. As with the rest of the market, we see sales taking a breather this third quarter and reporting a dip of 43% against Q2. However, looking closely at fig. 10.1, we find that this quarter sales matched 2017 numbers and even outdid 2016’s metric. With the trend line continuing to stay positive (fig. 10.1.2), we will be keeping an eye on how this dynamic market evolves over the next few months.

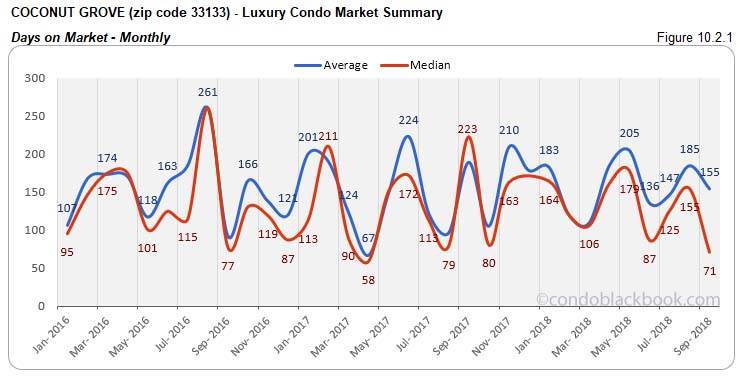

Days on market down 10% QoQ, but increase 19% YoY. Luxury condos in Q3 took 14 less days (on median) than Q2 to move off the market. However, they also took 21 days longer than same quarter last year (on median). This shows that buyers and sellers are still taking longer to get on the same page with negotiations.

Prices reduce QoQ and YoY. We see a 19% decline in the quarter-over-quarter median price and 1% decline year-over-year (fig. 10.3). Even the price per sq. ft. decreased 3% quarter-over-quarter to close at $415 per sq. ft. (fig. 10.4).

Inventory creeps up 3%, but still 12% lower YoY. We see a 3% increase in the months of inventory here, but the metric is still 12% lower than what it was a year ago. At 17 months, this is the only neighborhood in our study that has been the most dynamic in terms of inventory rotation and closest to reaching the ideal 9-12-month mark. Buyers should make their move fast to grab deals by searching Coconut Grove condos for sale here, or check out what lifestyle makes this vibrant neighborhood so dynamic here.

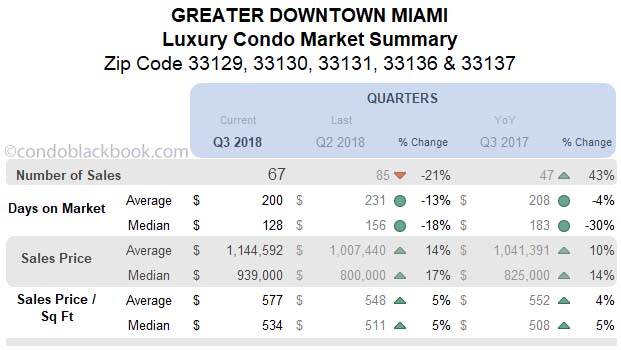

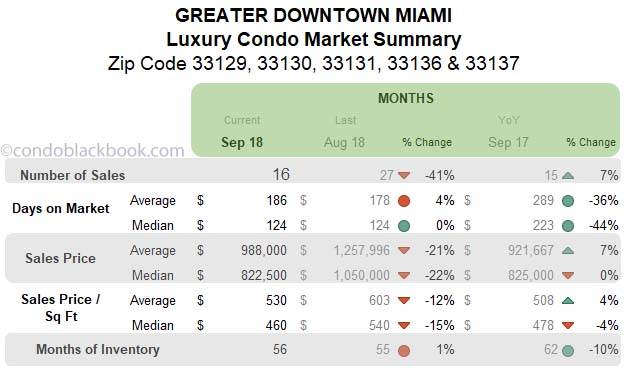

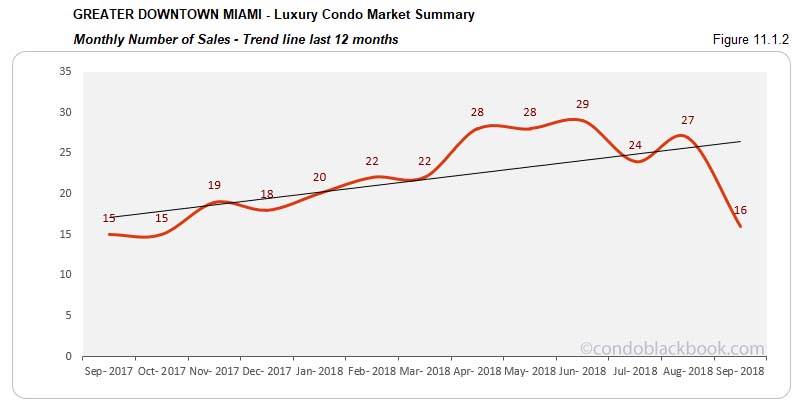

Greater Downtown Miami Luxury Condo Market Summary (33129, 33130, 33131, 33136, 33137 zips) back to top

Quarterly sales decline, but trend line and YoY numbers soar. While Q3 reported 21% less sales than Q2, it outdid the same time last year by 43%. Sales this third quarter also surpassed Q3 2016 (fig. 11.1). This is majorly since Q2’s sales momentum was carried through July and August, which is also visible in the upward soaring trend line of fig. 11.1.2.

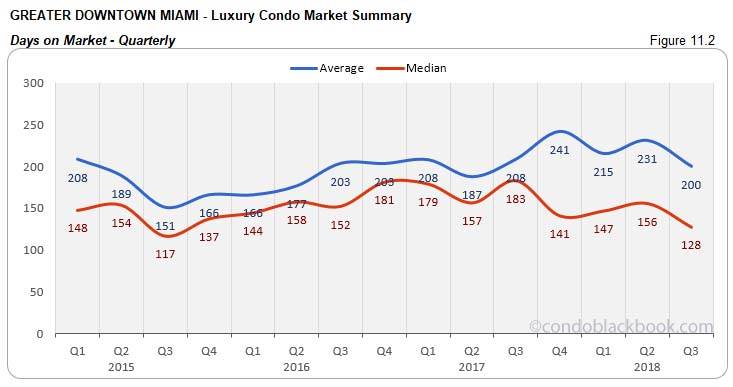

Days on market drop 18% QoQ and 30% YoY. Luxury condos in Q3 took 28 less days (on median) to get off the market compared to Q2 and 55 less days compared to Q3 2017. This just goes on to show that buyers and sellers continued having improved dialogue and negotiations in the past year in the Greater Downtown area.

QoQ and YoY price charts post uptick. We see prices going up consistently for the Greater Downtown area. There is a 17% increase in the quarter-over-quarter median price and 14% increase year-over-year (fig. 11.3). Even the median price per sq. ft. is up 5%, both QoQ and YoY, closing at $534 per sq. ft in Q3 (fig. 11.4).

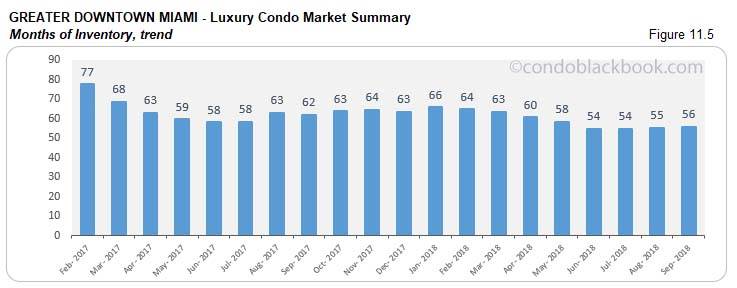

Inventory gains a percent, but still sheds 10% YoY. Just as sales took a break this quarter, so did the months of inventory (from their descending streak) by going up 1%. At 54 months, though the metric is 10% lower than previous year levels, it is still way off the 9-12-month mark of a balanced market. This gives buyers a great window of opportunity to search the Greater Downtown Miami area here for some amazing deals.

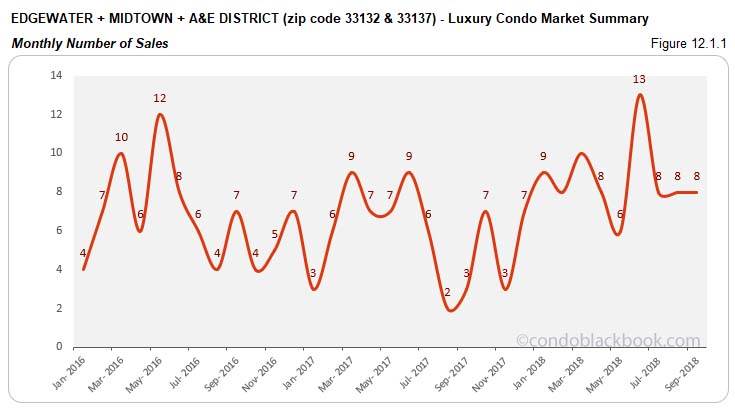

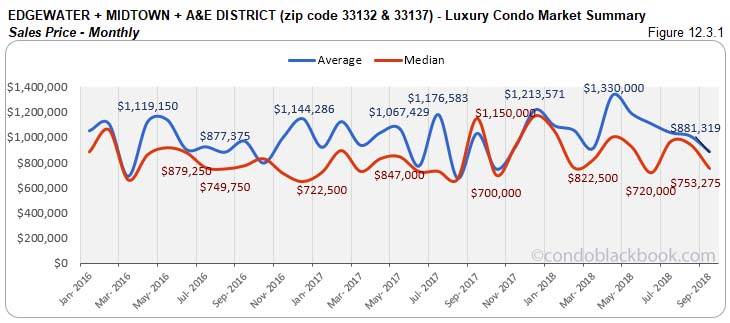

Edgewater + Midtown + A&E District Luxury Condo Market Summary (33132 + 33137 zip) back to top

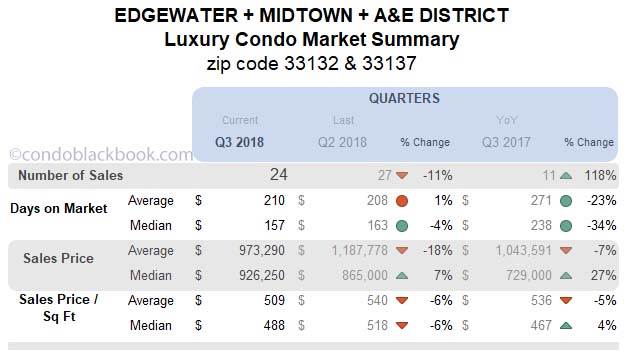

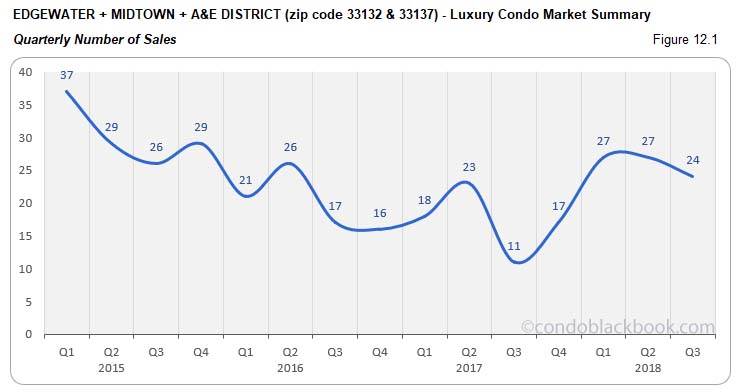

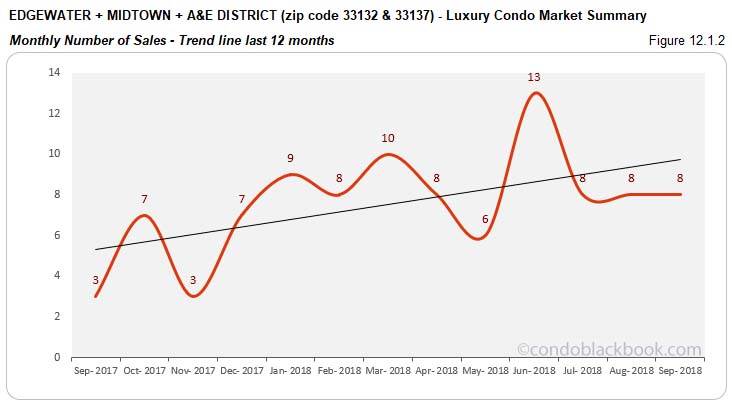

Quarterly sales sustain with improved YoY metrics and positive trend line. In spite of a seasonal dip, sales in Q3 close only 11% behind the second quarter (fig. 12.1). They also outdid same quarter last year by a good 118%. This keeps the trend line up and positive in fig. 12.1.2.

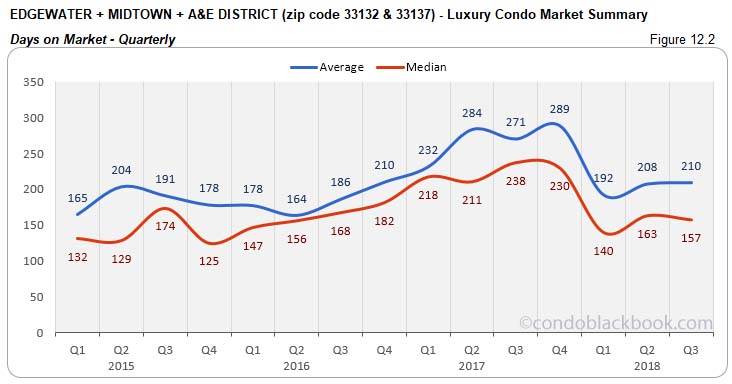

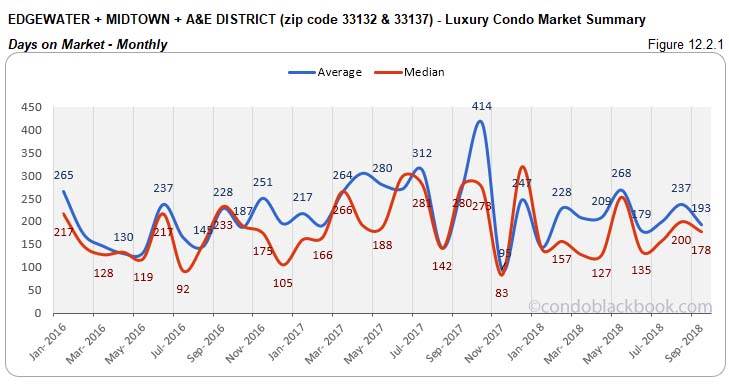

Days on market deflate 4% QoQ and 34% YoY. Luxury condos in Q3 took 6 less days (on median) to get off the market compared to Q2, and 81 less days compared to same time last year. This indicates how buyers and sellers have been more and more willing to see eye to eye over the course of one year.

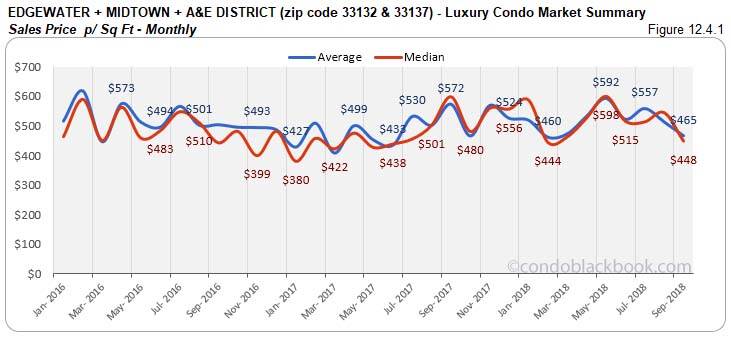

Prices move upwards with slight volatility. The price charts in this grouping show a bit of volatility, but mostly post a positive trend. While the quarter-over-quarter median price increased 7%, it also went up 27% year-over-year. There is also a 4% increase in the year-over-year price per sq. ft. By quarter-end, the median price per sq. ft. closed at $488. (see fig. 12.3 and 12.4)

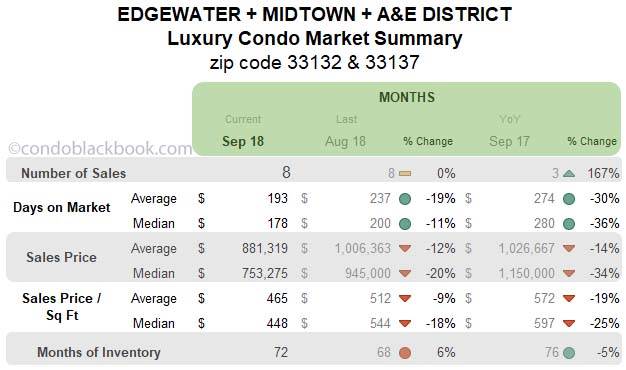

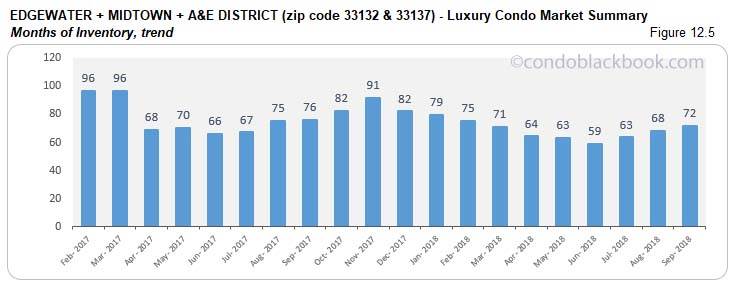

Inventory climbs 6% with 5% YoY reduction. Breaking its downward streak from last quarter, the months of inventory increased by 6% from August to September. However, the metric is still 5% lower than its previous year levels. At 72 months, this is one of the heaviest inventory markets in our study, and the furthest from reaching the 9-12-month ideal. Buyers definitely have the upper hand in negotiations and should browse through Edgewater condos for sale here or begin by exploring the individual lifestyle and condo options in Edgewater, Midtown and Arts & Entertainment District.

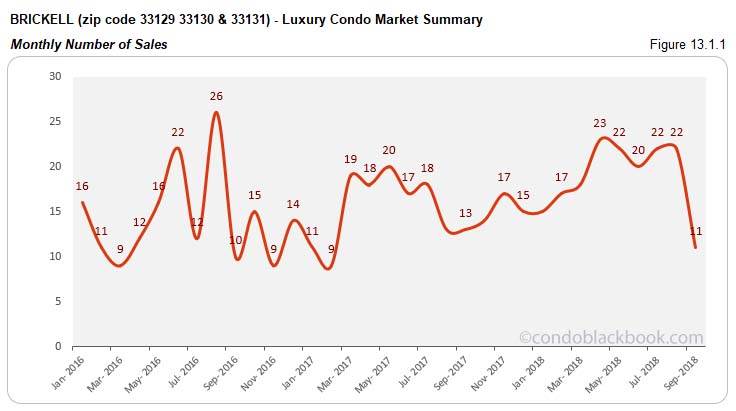

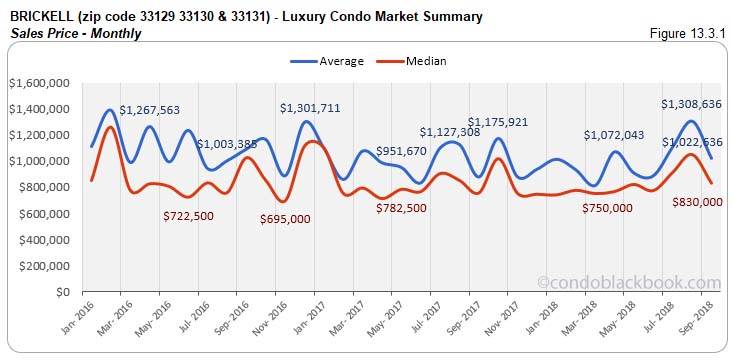

Brickell Luxury Condo Market Summary (33129, 33130, 33131 zip) back to top

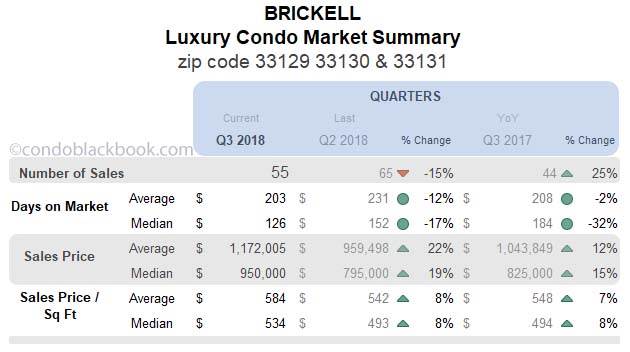

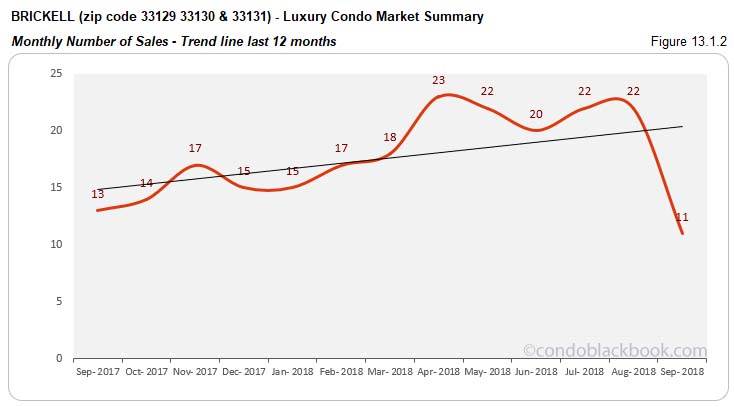

Quarterly sales dip slightly, but improve over past two years with positive trend line. Q3 posts a 15% decline in sales against Q2, but outdoes the same quarter in 2017 by 25%. This quarter’s sales also outperformed Q3 2016 owing to a strong July and August (fig. 13.1). With the trend line in fig. 13.1.2 staying positive, it’s easy to say that the luxury condo market here has not lost its dynamic.

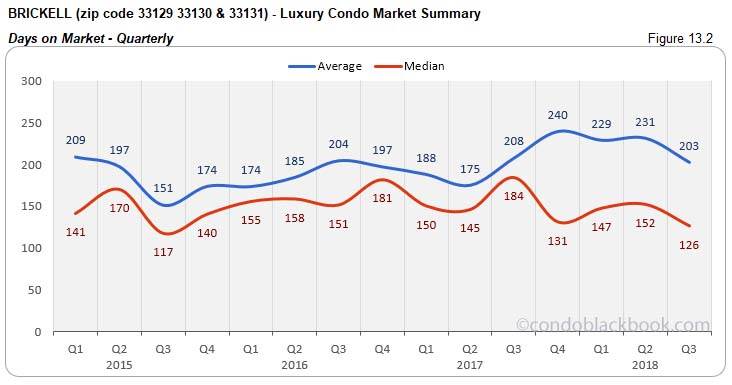

Days on market decrease 17% QoQ and 32% YoY. Luxury condos in Q3 took 26 less days (on median) than Q2 to move off the market, and 58 days less compared to same quarter last year. This shows that buyers and sellers have been coming to a consensus sooner in this business district over the course of the year.

Prices trend upwards QoQ and YoY. Both, the median price and median price per sq. ft. for Brickell went up in Q3. There was a 19% increase in quarter-over-quarter prices and 15% rise in year-over-year median prices (fig. 13.3). The price per sq. ft. too increased 8% year-over-year to close at $534 this quarter (fig. 13.4).

Inventory dips 1% quarter-end and 10% YoY. One of only three neighborhoods to report a decline in inventory in our study, Brickell closed the quarter with 50 months of inventory. With levels way off the ideal mark of 9-12 months, buyers still have the opportunity to make use of a market where supply highly exceeds demand. Seize the opportunity by searching Brickell condos for sale here or taking a tour through Brickell here.

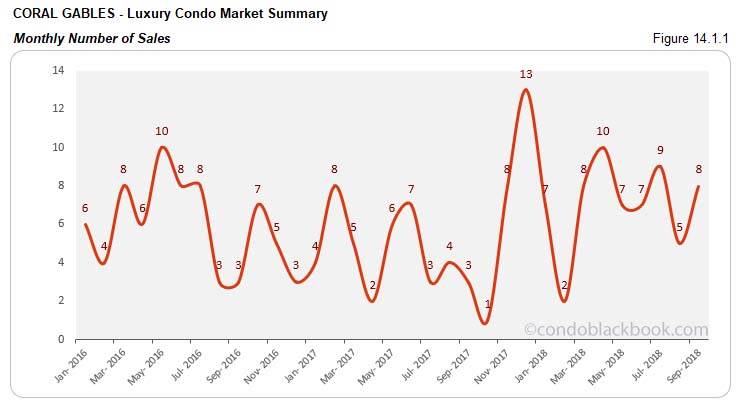

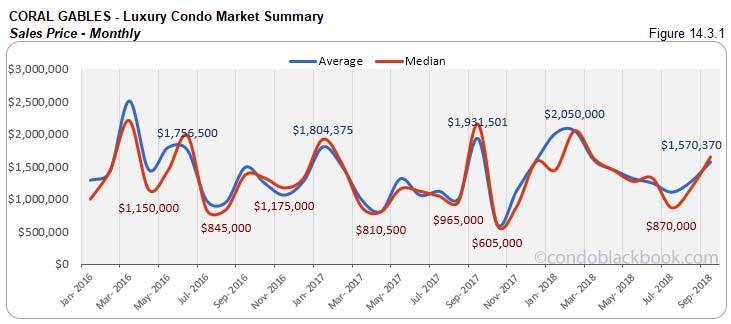

Coral Gables Luxury Condo Market Summary back to top

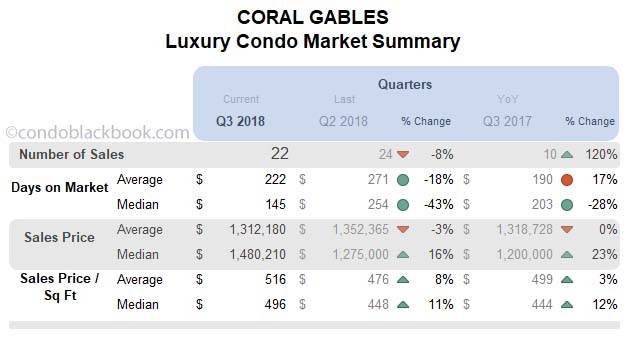

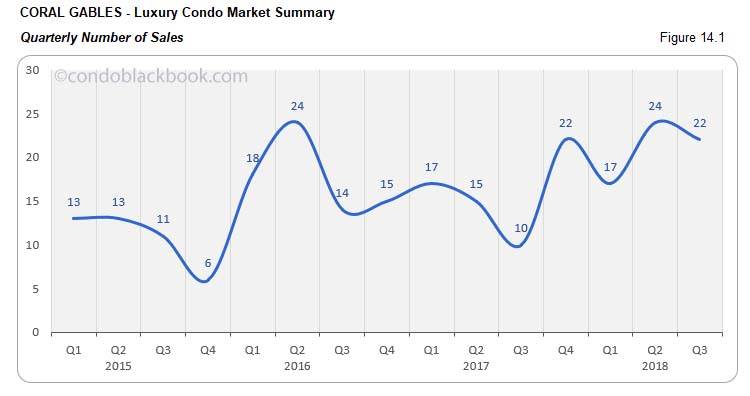

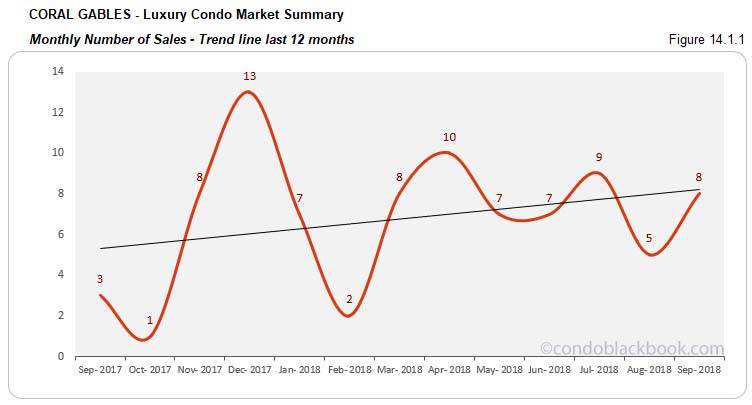

Quarter survives seasonal dip with improvement over last three years and positive trend line. Q3 posts a slight dip of 8% over Q2 in Coral Gables, but an astounding 120% increase over the same quarter last year. The metric even outdoes sales from Q3 2016 and 2015 (fig. 14.1). This dynamism helps keep the trend line in fig. 14.1.2 up and soaring.

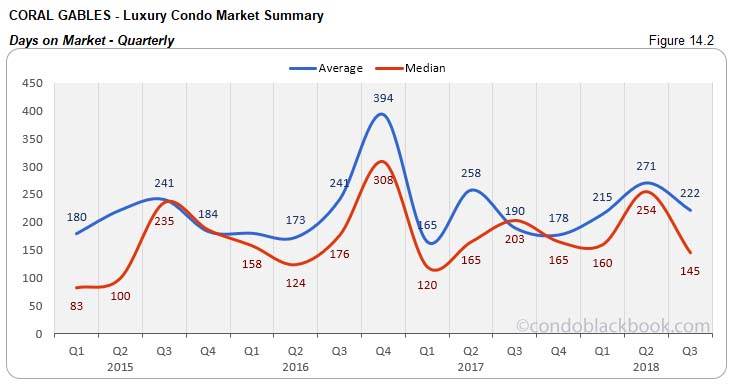

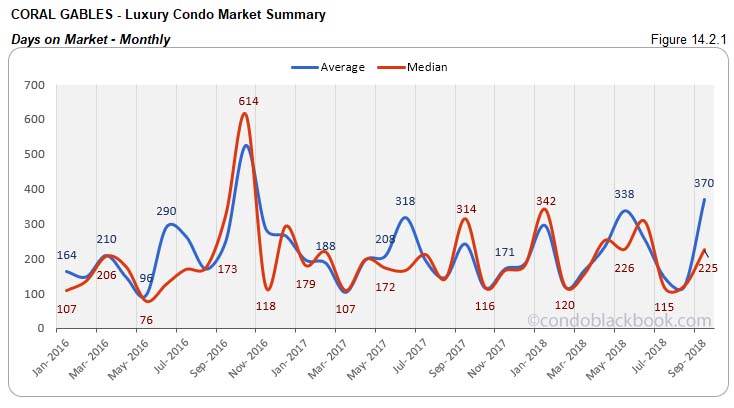

Days on market deflate 43% QoQ and 28% YoY. Luxury condos took 109 less days to get off the market compared to Q2, and 58 days less year-over-year. This goes to show that buyers and sellers took consistently less time to come to a consensus in Coral Gables through the year.

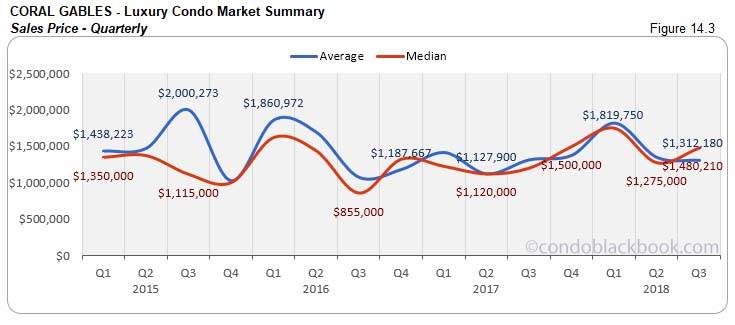

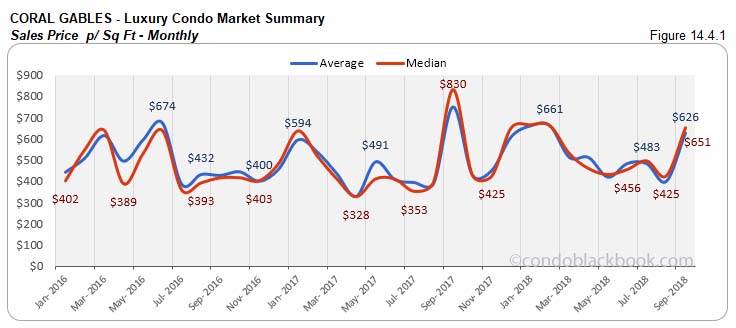

Uptick in QoQ and YoY prices. Q3 reports a 16% increase in quarter-over-quarter median prices and 23% increase in year-over-year median prices. The price per sq. ft. too closed 11% higher this third quarter at $496 per sq. ft. (see fig. 14.3 and 14.4 below)

Inventory down 5% and 42% lower YoY. The third quarter ended with inventory in September closing 5% below August and 42% lower year-over-year. At 21 months, this is not just one of the most dynamic markets closest to hitting the 9-12 month ideal, but also one of just three neighborhoods in our study that have reported a decline this quarter. With trends making a shift, buyers should be quick to grab deals by searching Coral Gables condos for sale here, or start by checking out the lifestyle options in Coral Gables here.

Conclusion back to top

Even with a seasonal dip numbers show strength against previous years, buyers are advised to work on closing deals sooner. For over two years the luxury condo market in Miami has largely been in favor of buyers. However, with the seasonal Q3 dip not being able to take numbers below previous year levels, we have reason enough to believe that the market has gained strength. Even the months of inventory have shown resilience, by increasing only slightly to accommodate the slower pace of sales. These factors should be taken as a hint by buyers to finalize deals while the odds are still in their favor (especially new construction resales which is being sold at similar or lower prices by first owners), and enjoy the ride once the tide turns.

Love what you see? Don’t forget to share our blog and subscribe (see the subscribe link on the top menu) to receive the latest market news in your inbox.

Have any questions? Or see something wrong with the stats? Please contact Sep at sniakan (at) hbroswell.com or call 305-725-0566.

Share your thoughts with us

Your Miami Condo Awaits

Recent Posts