Where to Find the Lowest Property Taxes in Miami?

Jun 06, 2023 June 06, 2023

Miami’s growth has skyrocketed over the years as more people choose to live here for its incredible weather and low taxes. But many people considering buying Miami real estate wonder what the property tax rates in Miami are.

And moreover, most people don’t love talking about property taxes. When looking for a home, buyers focus on more living aspects, like the square footage, layout, amenities, outdoor space, or the kitchen upgrades. Still, buyers must pay attention to property tax rates as part of their purchase, and also once they become owners as part of their budget.

If you’re considering buying a condo or house in Miami or Miami Beach, this guide will help you compare property tax rates in the most popular neighborhoods of Miami and the Miami Beaches, and where to find the lowest property tax rate in Miami Dade County.

This article was updated on June 6, 2023.

— Know Your Miami and Miami Beach Property Tax Rates

In Miami Dade County, property tax notices are sent out each year on October 30. We have provided updated property tax rates (see below) for 2022 and 2021 based on the Miami Dade annual millage rates.

As indicated in the table below, there’s not too much of a difference from the lowest to the highest Miami property tax rates. However, this quickly could turn into precious hundreds or thousands if you’re looking at high-end and luxury properties. And considering that Miami property values have increased significantly over the last few years.

While average Miami-Dade County property taxes are known to be high compared to other U.S. counties, in recent years, Miami area property taxes have actually decreased year-over-year (see below), adding to the extensive list of reasons why Miami is the best real estate market to invest in.

— Which Miami Dade City Has the Lowest Property Tax?

Most surprisingly, the Miami Dade city with the lowest property tax rate is the exclusive Key Biscayne with a 1.65% tax rate, while Biscayne Park has the highest Miami-area property tax at 2.54%. Also worth noting is that the exclusive beachfront neighborhood of Bal Harbour has low property taxes at 1.74%.

— Miami Dade Property Tax Rates - 2022, 2021 and 2020: Highest Property Tax to Lowest Property Tax

City | 2022 Property Tax Rate | 2021 Property Tax Rate | 2020 Property Tax Rate |

Biscayne Park | 2.46% | 2.52% | 2.54% |

El Portal | 2.34% | 2.39% | 2.40% |

Miami Shores | 2.28% | 2.36% | 2.37% |

North Bay Village | 2.17% | 2.25% | 2.24% |

North Miami Beach | 2.14% | 2.21% | 2.22% |

Indian Creek (Miami Beach) | 2.14% | 2.19% | 2.20% |

City of Miami* | 2.06% | 2.12% | 2.13% |

Greater Downtown Miami | 2.10% | 2.17% | 2.17% |

Miami Beach | 1.92% | 1.93% | 1.94% |

Surfside | 1.90 | 1.96% | 1.98% |

Bay Harbor Islands | 1.83% | 1.92% | 1.93% |

Coral Gables | 1.83% | 1.88% | 1.88% |

Pinecrest | 1.75% | 1.80% | 1.80% |

Sunny Isles Beach | 1.71% | 1.77% | 1.79% |

Unincorporated Miami-Dade County | 1.70% | 1.76% | 1.76% |

Aventura | 1.69% | 1.74% | 1.74% |

Bal Harbour | 1.68% | 1.73% | 1.74% |

Key Biscayne | 1.59% | 1.64% | 1.65% |

Don’t see your city here? Here’s the full list of 2022 Property Taxes for the Miami Area.

*The City of Miami includes Coconut Grove and Edgewater.

Edgewater, Miami FL.

— How Are Miami Property Tax Rates Calculated? Where Does the Property Tax Money Go?

While the chart above shows tax rates as a percentage, local governments don’t set rates in this manner. Each year, county and municipal governments, as well as local taxing authorities (such as the School Board, South Florida Water Management District, and Children's Trust), determine what the property tax rates will be for each city (also known as millage rates).

So cities approve millage rates instead. The millage rate is defined as the amount of property tax charged per $1000 of the assessed/taxable value of a property.

— How Are Miami Property Tax Millage Rates Calculated?

Understanding how Miami property tax and millage rates are calculated can be confusing. Here is how Miami property tax rates are calculated. Suppose the millage rate decided by your local government is 25 mills. This means you will be paying $25 for every $1000 of the assessed value of your property. This turns out to be 2.5% of the assessed/taxable value.

The local governments (city, county, etc.) determine property taxes based on their total budget needed to keep their jurisdiction running without financial issues. In Miami Dade County, the Property Appraiser’s Office assesses and mails out the current year property values by July. By figuring out how much total tax revenues they need, local municipalities will create the millage rate accordingly.

Typically, your property taxes will pay for parks, emergency services (fire, police), transportation, education, libraries and recreational activities. These are called non-ad valorem assessments.

— What Goes into Miami Dade’s Property Taxes?

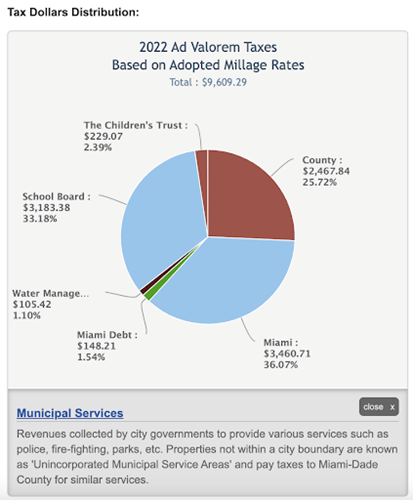

Miami Dade county also has an interactive property tax visualizer that shows you exactly where your tax money goes, and lets you compare it to other municipalities' millage rates.

Using the county’s property tax visualizer, here is an example of what the property tax and non-ad valorem taxes could be for a condo in Edgewater, Miami. This condo is a 2 bedroom, 2.5 bath with 1,673 square feet. Edgewater is within the City of Miami, so its millage rate for 2021 is 2.06%.

— What Affects Property Tax Rates in Different Neighborhoods?

As you may note in the above table, the economic status of a neighborhood doesn’t seem to affect property tax rates at all. Some of the more desirable Miami neighborhoods on the list are also the ones that enjoy a tax rate below 2%. High home values help keep rates down, so that explains lower rates in places like Key Biscayne, Bal Harbour, Miami Beach, and other neighborhoods with high property values.

Another major reason behind this disparity in rates is vertical development. For one, it’s logistically easier for a city to service blocks filled with high-rise condominiums, as opposed to a town that stretches out. For instance, it is cheaper to install and maintain a sewage line servicing a 60-unit condo as opposed to 60 houses in a row. And secondly, condo complexes pack in more taxpayers than larger single family home estates.

So, a new condo development in your area could actually translate into good news for your property tax!

If you have any questions about the possible property tax rate for a new condo or home you are looking at, please give us a call and we’ll be happy to help you.

Share your thoughts with us

Your Miami Condo Awaits

Recent Posts